International commuter assignments have come of age. Originally arising as exceptions to more traditional long-term or short-term assignment policies, commuter assignees, who regularly travel between their home location and another country in order to work, are increasingly considered to be a class of assignee in their own right. ECA’s recent International Commuters Survey looked at best practice in pay and policy for this type of assignment and uncovered an increasingly sophisticated and segmented approach to how they are managed.

Why commuting internationally is on the rise (and the challenges that poses)

International commuters represent only a small segment of most companies’ globally mobile workforce, but a rapidly growing one. 61% of respondents reported that the number of commuters they employ has increased within the last three years, with 69% expecting an increase in the next three years. A similar sample predict that the number of commuter assignments as a proportion of their total assignee workforce will also rise as they look to use them as an alternative to other assignment types.

Commuter assignments are most typically undertaken from a European home country to a European host country, most likely as a result of the comparative ease and speed with which commuters can travel between countries within the EU. However, commuter moves within Asia are also common, perhaps because, as found in this survey, Asian companies in particular consider commuter assignments to be a useful way of training local staff in the host country.

The most popular reason given for using international commuter assignments is that they are ideal for fulfilling temporary project needs. While this is true, the same could arguably be said of many other assignment types. The main reasons behind the rising use of commuter assignments are that they can help with managing family issues and also meet increasing employee demand for commuter arrangements (42% of companies reported that they manage commuter assignments that have been requested by the employee themselves). A likely reason for the higher demand is a desire to work internationally while being reluctant to disrupt a partner’s career or children’s education. Commuter assignments can be used as a compromise, a way to facilitate taking on a role in a different country without physically relocating. Despite some of the challenges associated with commuter assignments, discussed below, the need to have the right talent working in the right place means that companies are increasingly willing to be flexible and facilitate commuting arrangements to make this happen.

© Employment Conditions Abroad 2019

However, the rise in commuter assignments is not wholly attributable to the needs of employees. Over a third of companies use commuter assignments because the job role requires the employee to work in multiple locations or to provide cover at short notice. A similar proportion are expecting an increase in the use of commuter assignments because they perceive them to be more cost-effective and/or quicker to initiate than other assignment types. Companies looking to reduce costs should be cautious about using commuter assignments for this purpose, however, as they are not necessarily cheaper than other forms of international assignment. While the costs of relocation and potentially international school fees or family-sized accommodation in the host location are avoided, most companies are picking up the costs of weekly travel between the home and host locations, as well as the cost of goods and services and accommodation in the host location. Goods and services are often covered through a per diem and accommodation is provided in hotels or serviced apartments, less cost-effective options than a COLA or a rental property that are more commonly used for conventional assignments. A previous ECA article looks at the financial (and personal) costs of commuter assignments in more detail.

It is unsurprising that only 13% of companies report ease of administration as a reason for their increased use of commuter assignments. On the contrary, most survey participants reported that complexity of administration was one of their biggest challenges when managing commuters, along with tax and immigration compliance and cost control.

© Employment Conditions Abroad 2019

These reported challenges have changed little since our last survey about commuter assignments in 2012; however, the latest survey highlights many ways in which companies are changing how they manage these assignments in order to address them.

Boosting compliance through improved governance

The survey looked at how companies manage both temporary and permanent commuter assignments; i.e. where the assignment is set to be for a defined and limited period, usually to complete a specific project, and when the commuting arrangements are set to continue indefinitely. Permanent commuters are less common than temporary ones and more likely to arise ad hoc without those responsible for the company’s global mobility (GM) programme being aware of them. GM’s familiarity with the complexities of working across borders and their understanding of the company’s mobility policies and procedures means their oversight is crucial to ensure both cost-control and compliance.

It is encouraging, then, that 67% of companies now have or are developing a formal written policy by which to govern their permanent commuter arrangements, a significant increase over the last seven years (the equivalent figure for temporary commuters is 75%, which has seen a smaller rise). By specifying the procedures to be followed and the allowances and benefits to be provided, formally documented policies can greatly assist with both compliant and cost-effective assignment management. As the number of commuter assignees grows, so does the risk of non-compliance and escalating costs, so it is more important than ever for companies to have a policy in place.

The tax and social security position of international commuters can be particularly complex, with possible liabilities and payroll obligations in both the host country where they work and the home country in which they are based, and where they may also have workdays. Tracking the number of days spent in each country is vital for ensuring compliance. Further evidence that GM teams have succeeded in gaining far more oversight of commuter assignees than they had seven years ago is shown by the finding that more than half of the companies that track the movements of commuter assignees have centralised this task with the GM team (previously the responsibility was shared across home and host HR functions and line managers). Less positive news is that currently only half of companies track all their commuters, although a further third track some of them, usually when there is a known compliance requirement.

Technology has an increasingly important role to play in tracking, with the proportion of companies leveraging the data from their travel booking platforms, for example, almost doubling in the past seven years. Few rely on spreadsheets or manual record keeping anymore, and as government scrutiny of commuters and frequent business travellers looks likely to increase, companies’ use of purpose-built tracking software such as Global Tracker is likely to increase also.

© Employment Conditions Abroad 2019

Another way that companies have been tackling the compliance challenges of commuter assignments is through increasing investment in relevant professional services. The number of companies providing their commuters with tax return assistance has risen by nearly 10% since the last survey and 76% of companies now engage tax professionals to brief their commuter assignees about the tax implications of their assignment, compared to 60% seven years ago. Reliance on advice from companies’ internal taxation and legal departments to the HR teams to ensure compliance has dropped significantly over the same period. Using professional tax and immigration services reduces the risk of non-compliance but adds to the overall cost of commuter assignments. And while many commuter assignments take place within the EU and therefore avoid the need to consider immigration requirements, the as-yet-unknown outcome of Brexit, now scheduled for the end of October 2019, may result in additional requirements and costs to consider.

Managing costs through leaner packages

By creating policies specific to commuter assignments, companies are now able to provide much leaner remuneration packages than they did seven years ago, when many would have had to apply their long-term or short-term assignment policy in the absence of anything else. Flexible policies that differentiate between temporary, permanent and self-initiated commuter arrangements provide further opportunities for cost savings, with packages for permanent commuters tending to be leaner than those for temporary commuters and packages for self-initiated assignments being leaner still.

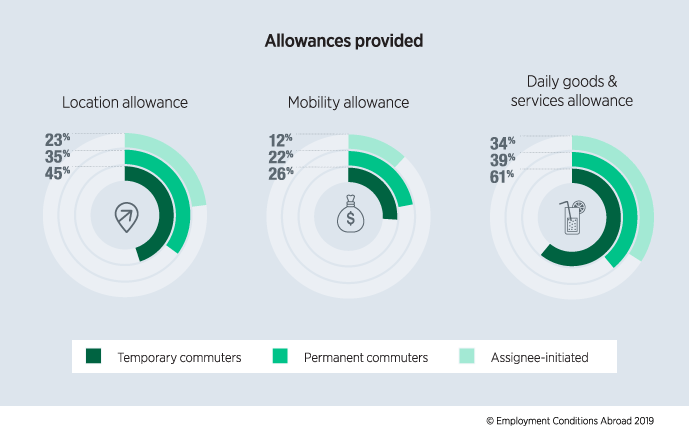

The prevalence with which companies cover the costs of day-to-day goods and services has dropped significantly since the last survey. It is still a majority of participants (61%) that cover this cost for temporary commuters, but this figure was 94% in 2012. Only 39% cover these costs for permanent commuters, another significant drop since last time, and only 34% cover them for assignees who requested the commuting arrangement themselves. There has also been a noticeable shift towards only covering goods and services expenditure on workdays in the host country rather than every day, making provision less generous still. The most common way to cover these costs is through a per diem/daily rate.

© Employment Conditions Abroad 2019

While mobility allowances remain a common component of long-term assignment packages they are fairly rare for commuter assignments. As flexible commuter arrangements are often put in place for the assignee’s benefit, companies have capitalised on the reduced need to provide an incentive for them to accept the assignment. Only 26% of companies provide mobility allowances to temporary commuters, about half the number that provided them seven years ago. Fewer still provide them to permanent commuters and where commuter arrangements have been requested by the assignee. Mobility allowances are paid by a higher proportion of companies with headquarters in Asia than elsewhere in the world, however, implying that employees of these companies require greater incentivisation to agree to a commuter assignment. This theory is supported by the finding that fewer Asian-headquartered companies report having assignees specifically requesting commuter assignments themselves.

Provision of a location allowance in recognition of the challenges linked with adapting to life in another country is more common, covered by 45% of companies to temporary commuters (again the numbers are lower for permanent and assignee-initiated arrangements). While these figures are similar to those reported seven years ago, provision of these allowances is still much less common than for long-term assignments.

Conclusion

The use of commuter assignments is set to continue rising as they provide a flexible way to mobilise talent quickly, while minimising the impact on employees’ personal lives and families. However, these advantages are offset somewhat by an increased administrative burden, compliance risks and the potential for high costs in the host location. Global mobility teams have succeeded in gaining more oversight of their companies’ commuter populations, improving compliance through better tracking and judicious use of professional tax and immigration services. The prevalence of more structured, specific policies for these types of assignment show that they are here to stay, and companies have taken the opportunity to reduce costs by making average commuter packages leaner than they were a few years ago.

FIND OUT MORE

To benchmark and review your international commuter policy based on best practice in the industry, you can purchase a copy of the survey results from the Surveys area of our website.

The most common way that companies cover day-to-day living expenses for commuter assignees is through a per diem or daily rate. ECA’s Daily Rates Calculator helps you to calculate daily living allowances for assignees and business travellers, customised to include your choice of hotel, food and drink and public transport options.

Our experienced consultancy team can help you to design global mobility policies, whether you are creating them for the first time or reviewing existing documents. Contact us to find out more.

Please contact us to speak to a member of our team directly.