For many years, the Global Mobility profession has relied on the so called “183-day rule”. This so-called rule assumes that there are no tax issues for an employee working on a short-term basis in a country other than their home location, as long as the employee is not present in a host country for more than 183 days during the relevant 12-month period and that they are paid by their home location. However, the “183-day rule” is not actually a rule but rather an exception to another rule, that tax is paid in the location an individual’s employment is exercised.

Article 15 of the OECD Model Tax Treaty Convention, which serves as a guideline for establishing tax agreements between members of the OECD, states that employment income is taxable in the country where the employment is exercised. However, paragraph 2 of Article 15 provides an exemption to the general rule, and employment income may be taxable in the country of residency if the following three criteria are met:

a. the employee is present in the other State for a period or periods not exceeding in the aggregate the 183 days in the relevant treaty period (e.g. calendar year, fiscal year, any 12-month period), and

b. the remuneration is paid by, or on behalf of, an employer who is not a resident of the other State, and

c. the remuneration is not borne by a permanent establishment which the employer has in the other State.

It is from this that the so called “183-day rule” has stemmed. However, in recent years, when determining whether this exemption will apply, more and more emphasis has been placed on deciding whether conditions (b) and (c) have been fulfilled and questioning who should be considered the “employer” under the provisions of such double-tax treaties. Is it the entity with which the employee has their legal employment contract, or should other aspects be considered as well?

In 2010 the OECD revised its guidance relating to Article 15 and introduced the concept of the economic employer. The commentary plays an important role in this context, as it indicates that the "employer" of a globally mobile employee may not necessarily be the legal employer. In determining who the employer is, other factors such as the following should be considered:

- who has the authority to instruct the individual regarding the manner in which the work has to be performed;

- who controls and has responsibility for the place at which the work is performed;

- the remuneration of the individual is directly charged by the formal employer to the enterprise to which the services are provided;

- who puts the tools and materials necessary for the work at the individual’s disposal;

- who determines the number and qualifications of the individuals performing the work;

- who has the right to select the individual who will perform the work and to terminate the contractual arrangements entered into with that individual for that purpose;

- who has the right to impose disciplinary sanctions related to the work of that individual;

- who determines the holidays and work schedule of that individual?

Based on this approach, substance should prevail over form. This means that the term “employer” should be considered in a broader sense and the whole context of the employment should be reviewed to determine which entity is the economic employer of the employee under the provisions of the treaty to then be able to decide whether exemption under Article 15 can be granted to avoid host country taxation. Many countries such as Germany, Luxembourg and Sweden are increasingly considering not just the duration of the assignee’s stay but also the nature of the work performed, who controls that work and who benefits from it.

The below table provides an overview of which of the major nations for business travel spending adopt the economic employer approach:

|

Country

|

Does the Country use the economic employer approach? |

OECD Member State |

| China |

|

|

| United States |

Not explicitly applied |

|

| Germany |

|

|

| Japan |

Possibly1 |

|

| United Kingdom |

|

|

| France |

|

|

| India |

|

|

| Korea, Republic of |

|

|

| Italy |

|

|

| Brazil |

|

|

| Canada |

|

|

| Australia |

|

|

| Spain |

No clear position2 |

|

| Netherlands |

|

|

| Russia |

Possibly |

|

-

It is clear from this summary table that when assigning employees abroad on short-term assignments, employers need to always be mindful of the host country’s interpretation of the definition of ‘employer’ for the purpose of determining whether an exemption from taxes will apply on employment income under the terms of the double-tax treaty. Japan does not currently adopt the economic employer approach. However, employment income is considered Japanese sourced when remuneration is earned for services rendered in Japan, regardless of where or when the remuneration is paid. On this basis, the Japanese authorities would consider the facts and circumstances of particular cases.

-

The Spanish tax authorities have not yet established a clearly defined position in relation to the economic employer approach.

Below is a more detailed analysis of the economic employer approach in Germany, Sweden and the United States – all of which address this issue in different ways.

The economic employer approach in Germany

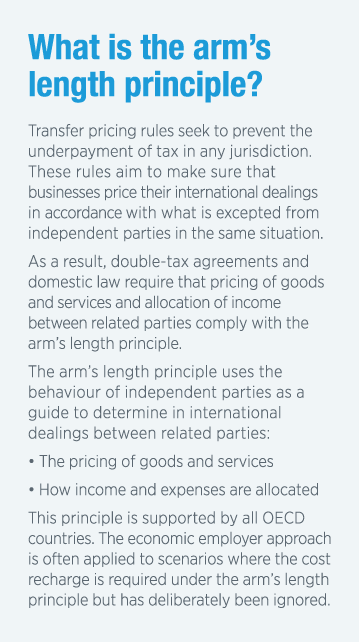

Germany fully supports the economic employer taxation concept. In considering who is a seconded employee’s employer for the purpose of taxing rights, the German tax authorities do not rely solely on the civil law aspects  of who the employer is, but also place weight on the economic considerations. A German company will be considered a seconded employee’s economic employer where the German company financially bears the wages for the work performed. Therefore, salaries that are paid by a foreign employer (who does not have a permanent establishment of the foreign organisation in Germany) but are recharged to the separate German company would be subject to withholding tax in Germany. The same applies as of 2020 for salary that is not actually recharged but should have been recharged under an arm's-length principle. The German company is deemed to be the economic employer and thus required to calculate and transfer the appropriate wage tax return to the tax office on day one. Many jurisdictions have taken a similar approach with looking at cross-charging of costs as the deciding factor. Such an approach places emphasis on the need for global companies to be aware of where their employees are, what they are doing and for how long. Companies need to be tracking these employees and counting their days present in these jurisdictions.

of who the employer is, but also place weight on the economic considerations. A German company will be considered a seconded employee’s economic employer where the German company financially bears the wages for the work performed. Therefore, salaries that are paid by a foreign employer (who does not have a permanent establishment of the foreign organisation in Germany) but are recharged to the separate German company would be subject to withholding tax in Germany. The same applies as of 2020 for salary that is not actually recharged but should have been recharged under an arm's-length principle. The German company is deemed to be the economic employer and thus required to calculate and transfer the appropriate wage tax return to the tax office on day one. Many jurisdictions have taken a similar approach with looking at cross-charging of costs as the deciding factor. Such an approach places emphasis on the need for global companies to be aware of where their employees are, what they are doing and for how long. Companies need to be tracking these employees and counting their days present in these jurisdictions.

The economic employer approach in Sweden

The Swedish government has recently introduced the economic employer concept into law, effective 1st January 2021. From the beginning of this year, factors beyond who pays the employee’s salary will have to be considered in identifying the employer and then assessing if the employee is liable to pay tax in Sweden when working there on a temporary basis. As it now stands, the government provides an exemption for employees working within a corporate group if the employee works for a maximum of 15 days in a row or 45 days in total during a calendar year. Previously, foreign employers without a permanent establishment (PE) in Sweden were not required to withhold tax on income, but instead the onus was placed on the employee to pay any taxes directly to the Swedish Tax Agency. However, going forward, foreign entities without a PE in Sweden will be required to withhold tax on wages paid to employees for work performed in Sweden, register as an employer with the Swedish Tax Agency and submit PAYE tax returns on an individual level if the work is subject to tax.

The economic employer approach in the United States

The United States has not explicitly adopted the economic employer concept, but a non-resident alien will not be subject to tax on income received for personal services performed in the United States where the following three conditions are met:

a. The employee performs services of or under a contract with a non-resident alien individual, foreign partnership, or foreign corporation, not engaged in a trade or business in the United States; or the employee works for an office or place of business maintained in a foreign country or possession of the United States by a US corporation, a US partnership, or a US citizen or resident.

b. The employee performs these services while they are a non-resident alien temporarily present in the United States for a period or periods of not more than a total of 90 days during the tax year.

c. The pay for these services is not more than USD 3 000.

Where these conditions cannot be met, most double-tax treaties with the United States will provide an exemption from US tax on employment income earned by non-resident aliens as long as the following three conditions can be met:

a. the individual is present in the United States for a period or periods not exceeding 183 days in any 12-month period that begins or ends during the relevant tax year; and

b. the remuneration is paid by, or on behalf of, an employer who is not a resident of the United States; and

c. the remuneration is not borne as a deductible expense by a permanent establishment that the employer has in the United States.

If a foreign person pays the salary of an employee who is employed in the United States, but a US corporation or permanent establishment reimburses the payor with a payment that can be identified as a reimbursement, neither condition (b) nor (c) will be considered to have been fulfilled and the US will deny this treaty exemption.

Conclusion

It is essential to consider that the OECD issues only guidelines, not legislation. OECD member countries are not required to follow its advice in drafting and interpreting treaties or local tax legislation. But it is certainly true that the definition of the economic employer is gradually being accepted by many countries, with some implementing it more vigorously than others. Challenges for international business travellers are increasing and countries with new policies and guidance are upending the traditional 183-day principle.

Therefore, what is glaringly obvious is that companies with a mobile workforce need to be tracking and monitoring these employees. Employers will need to know on a real-time basis where their employees are and what are the risks associated with their travel, and adequate records will need to be kept on all employees in relation to any tax positions taken.

More recent developments in the areas of remote working will only exacerbate these issues. If your employees have been working remotely during the Covid-19 pandemic they may already have triggered economic employer liabilities – it is important to remember they are still working and not just visiting. Problems that were traditionally part of business traveller management could now be part of remote worker policy.

While many tax authorities have issued holding notices about being flexible on overstays or displacement during Covid-19, Spain has recently broken with this policy and announced that it will not make exceptions for days of presence due to the impact of Covid-19.

Companies that have a distributed workforce should now carry out a ‘look-back’ audit of their displaced workforce to gather data around potential thresholds that have been or may be about to be breached.

This article was first published in the International HR Advisor.

FIND OUT MORE

To discuss how Global Tracker could help you with a ‘look-back’ audit, or to find out more about how to manage the compliance risks associated with business travel, contact the team today.

Please contact us to speak to a member of our team directly.