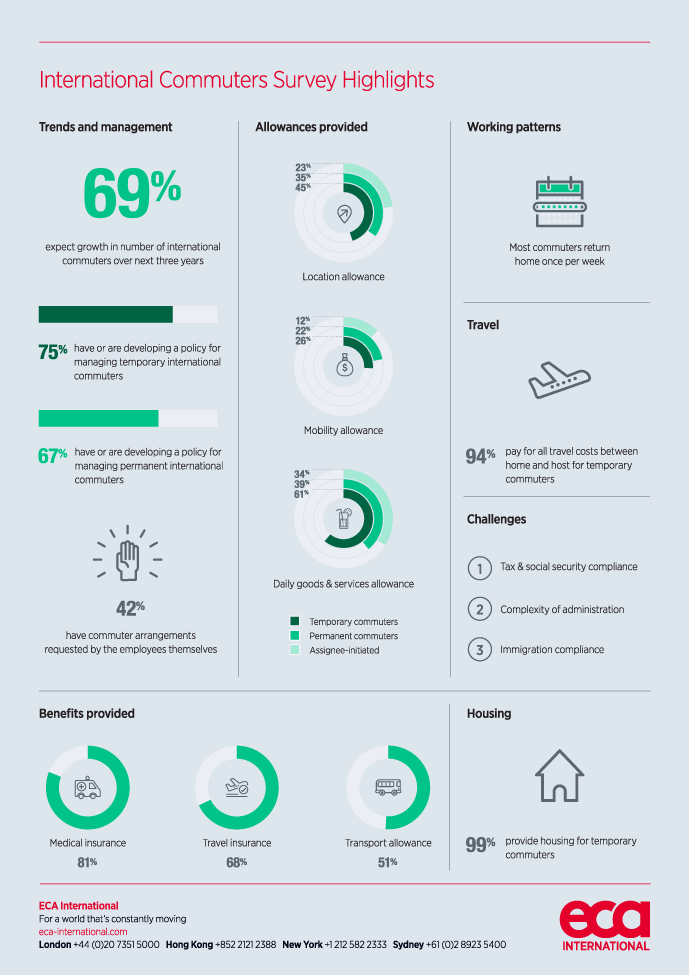

International commuters, who regularly travel between their home location and another country in order to work, represent a small but growing segment of many organisations’ mobile employee populations. Nearly 70% of companies in ECA’s recent International Commuters Survey expect their commuter numbers to rise further in the next three years and give employee demand and family issues as the most common reasons why. Commuter assignments can be used as a compromise that enables an employee to work internationally without disrupting their partner’s career or children’s education.

The rise in commuter assignments is not wholly driven by employees, however. About a third of companies are expecting more commuter assignments because they perceive them to be more cost-effective and/or quicker to initiate than other assignment types. The survey shows that in recent years companies have been making salary packages for commuter assignments leaner, but they are not necessarily cheaper than more traditional assignments. While the costs of relocation and potentially international school fees or family-sized accommodation in the host location are avoided, most companies are picking up the cost of the weekly commute as well as daily living expenses and accommodation costs in the host location.

A bigger challenge than cost management, however, is managing tax and immigration compliance and the complexity of administration associated with this. The tax and social security position of international commuters can be particularly complex, with possible liabilities and payroll obligations in both the host country where they work and the home country in which they are based, and where they may also have workdays. And while many commuter assignments take place within the EU and therefore avoid the need to consider immigration requirements, the as-yet-unknown outcome of Brexit, currently scheduled for the end of October 2019, may result in additional requirements and costs to consider.

In addition to reporting on the latest trends and challenges involved in managing international commuters, the survey looked at best practice in compensation and benefits provision for these employees and the differences in policy applied to those commuting on a temporary, permanent or self-initiated basis. Some highlights from the survey are shown below.

FIND OUT MORE

To benchmark and review your international commuter policy based on best practice in the industry, you can purchase a copy of the survey results from the Surveys area of our website.

Our experienced consultancy team can help you to design global mobility policies, whether you are creating them for the first time or reviewing existing documents. Contact us to find out more.

The most common way that companies cover day-to-day living expenses for commuter assignees is through a per diem or daily rate. ECA’s Daily Rates Calculator helps you to calculate daily living allowances for assignees and business travellers, customised to include your choice of hotel, food drink and public transport options.

Please contact us to speak to a member of our team directly.