What is best market practice when providing transport benefits for international assignees and how do you as a global mobility professional decide what is suitable to provide given personal and local circumstances?

Results from ECA’s latest Benefits for International Assignments Survey showed that more than three-quarters of those who responded sometimes provide either a car benefit or car allowance in the host country and just over a third (37%) sometimes pay a public transport allowance. However, companies vary their approach from country to country or city to city, considering factors such as host country practice and the safety, convenience and availability of public transport.

Cars

The graphic below shows the five most common factors considered by companies when deciding whether or not an assignee receives a company car in the host location. Personal security is considered the most important factor, closely followed by the quality of public transport and quality of driving and road safety. The actual cost of providing the car benefit is far less important, considered by only 16% of companies.

Factors affecting car provision in host country

0

%

Personal security

0

%

Quality of local transport

0

%

Road safety standards

0

%

Assignee job role

0

%

Location of workplace

© Employment Conditions Abroad 2019

The assignee job role and location of workplace will also dictate the type of provision. Logically, a salesperson that has to cover an entire country or region is likely to be provided with a car. With the car practically being the assignee’s office for such roles, it would arguably be counterproductive not to provide it. On the other hand, an assignee who will be entirely office based in a city with excellent public transport facilities has less need to be provided with a car and the company could consider providing a public transport allowance instead.

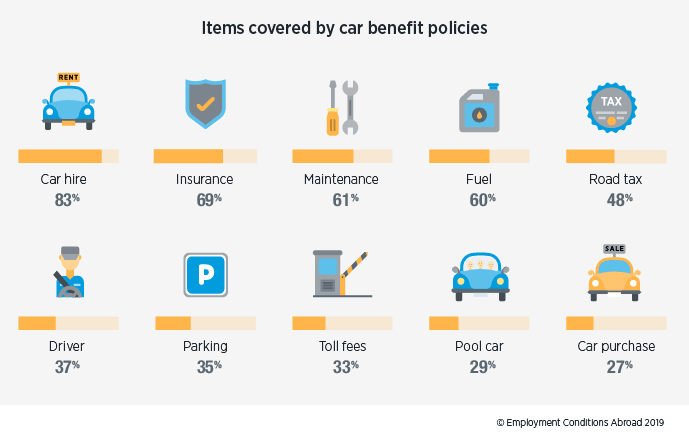

In addition to the car itself, other costs may be covered as well, such as insurance (69%), car maintenance (61%), fuel (60%) and road tax (48%). However, paying for drivers, road tolls, congestion charges and parking fees is less common, done by only around a third of respondents.

Common reasons for providing a driver include dangerous driving or security conditions or where it is common practice in the host country. In India and Indonesia for example we see a higher number of companies providing a driver in addition to the car itself (51% and 56% respectively).

Common reasons for providing a driver include dangerous driving or security conditions or where it is common practice in the host country. In India and Indonesia for example we see a higher number of companies providing a driver in addition to the car itself (51% and 56% respectively).

Most companies provide company cars in line with host country practice or a specific policy for international assignees. However, complications can arise if the assignee is not entitled to a car on the host side but previously received one at home. In this case it may be necessary to compensate the assignee with an allowance in lieu of the car, or include its value in the base salary on which assignment compensation is based (under a home-based approach). This will ensure the assignee is not worse off and meet legal obligations if the car still forms part of their contract. If the home contract has been terminated, however, the company is no longer legally obliged to provide a car in the host location.

Public transport

Public transport benefits are less commonly provided than car benefits and typically only where local public transport is of a suitable standard in the host location. In Hong Kong for example, public transport is well developed, clean and efficient and is probably a better option than driving. With over 2000 km worth of roads (1245 miles), Hong Kong has one of the highest road traffic densities in the world, and the government actively discourages car ownership through high car registration taxes and parking fees.

Whether to provide a car or public transport benefit will also not necessarily be a country-wide decision. Taking the US as an example, in New York, public transport is probably more appropriate as it is of a suitable standard and traffic can be chaotic, particularly from the viewpoint of a newly arrived expatriate. However, outside the big cities public transport in the US is not as readily available and having a car is vital to get around. In fact, families may need more than one car, although companies typically only provide one per assignee.

Delivery of transport benefits

The way in which transport benefits are provided varies for reasons such as tax efficiency, ease of administration and company philosophy.

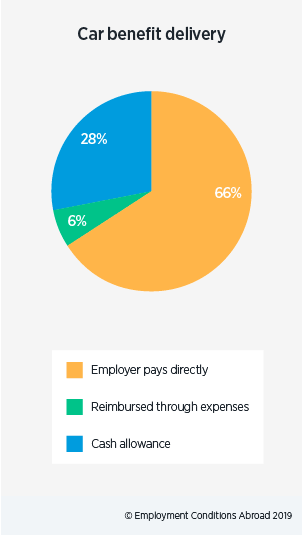

Providing the car as a benefit ‘in-kind’ is the most common approach, cited by 66% of respondents to the survey. This means the employer pays for the car and associated costs directly, which may be the most tax-efficient method and gives employers control over what is provided. However, this can be a more administration-heavy and time-consuming approach, which is a cost in itself. Organisations will have to decide what they wish to achieve when devising their policies – either increased tax efficiency or a reduction in administration burdens and costs.

In light of this, some organisations provide a cash allowance (28%), designed to cover the costs of a car. The advantages of this are that it requires less administration and leaves the assignee free to spend the money as they deem fit. On the flipside, giving the assignee such freedom may be seen as the employer neglecting their duty of care – an assignee in a dangerous location could, after all, be pocketing the money and walking to work through unsafe areas instead of spending it on a secure vehicle. Although there is additional administration involved, providing the car as a benefit in kind should ensure the assignee moves about the city more safely. Furthermore, a cash allowance is in most countries subject to tax in full, which in turn increases the actual costs.

A third option used by a small minority of companies (6%) is through expensing. Some companies require their assignees to pay for cars themselves and then claim the expense as a reimbursement from the organisation. This approach ensures the assignee spends the money as intended, while giving some flexibility and choice to the assignee. However, this will again generate more administration, not only for the organisation having to process these reimbursements, but also for the assignees themselves.

A third option used by a small minority of companies (6%) is through expensing. Some companies require their assignees to pay for cars themselves and then claim the expense as a reimbursement from the organisation. This approach ensures the assignee spends the money as intended, while giving some flexibility and choice to the assignee. However, this will again generate more administration, not only for the organisation having to process these reimbursements, but also for the assignees themselves.

An alternative more commonly used to compensate assignees for public transport costs is to cover the differential by comparing the costs of public transport in the host and home locations. One way of doing this is to include public transport in ECA’s shopping basket when calculating the cost of living index. The theory behind this decision is that the assignee would have costs for transport at home already, and a company may just want to compensate for the difference rather than pay for the costs of host transport in full.

Summary

Making a decision on transport benefits for international assignees is complex as so many different factors play a role. Best practice can be dictated by the assignee’s job role, local custom, security considerations and the quality of public transport in the host location, among other things. Fortunately, ECA’s annual MyExpatriate Market Pay survey, which benchmarks pay levels and packages for expatriates around the world gives participants an overview of best market practice for various benefits, including transport – a great first stop to learn about best market practice in the host country. The next survey opens in June.

FIND OUT MORE

ECA's new Transport Reports provide everything you need to assess the cost of providing cars and public transport benefits for globally mobile employees. They are available as part of an ECA data subscription and include annual car allowances and new car prices, figures for insurance, road tax and other motoring costs, public transport travel-pass costs and much more.

The MyExpatriate Market Pay Survey opens in June! The survey benchmarks pay levels for expatriates around the world, including information on salaries, benefits, allowances and tax treatment. Results are available exclusively to participants, who receive a free report for each country they submit data for.

Please contact us to speak to a member of our team directly.