Tax regimes vary significantly around the world. Employees in Denmark can expect to spend up to half of their income on taxes, while in Qatar there is no personal income tax at all. Russia applies a flat rate of tax for all residents, while many other countries implement progressive rates based on income.

Moving an employee from one country to another may also impact their tax residency and tax liability. Once they become a tax resident in the host country, an assignee’s income will be subject to income tax there, regardless of where they are paid. At the same time, there may be continuing tax and social security liabilities in the home country if they remain tax resident there during the assignment. Countries such as the Netherlands also offer tax concessions for highly skilled foreign workers, which may result in a tax liability that is much lower than that of a local national.

To determine who is responsible for bearing the cost of these potential tax differences, it is critical that companies have tax management policies in place when sending employees on assignment. An effective tax management policy also helps promote mobility by ensuring that the tax regime in the host country is not the deciding factor for whether to accept an assignment.

There are two common approaches used, known as tax equalisation and tax protection.

Tax equalisation

In simple terms, tax equalisation means that an assignee pays no more and no less tax on assignment than they would have paid had they stayed at home. Tax equalisation remains the most common approach to tax management according to our latest Expatriate Salary Management Survey, with 75% of companies applying it.

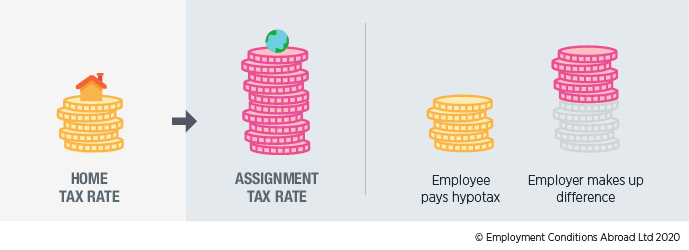

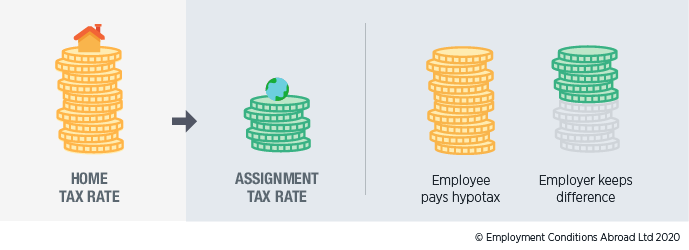

The company is responsible for paying all actual taxes in the home and host country on behalf of the assignee. The employee’s contribution to this is the hypothetical tax (or hypotax) that they would have paid had they not gone on assignment. This is subtracted from the notional home salary in the calculation of the assignment salary using the build-up or balance sheet approach.

Once on assignment, if the actual tax due is higher than the hypotax withheld, the employer pays the difference.

If the actual tax is lower than the hypotax, the employer keeps the difference.

One thing to bear in mind regarding tax equalisation is that payment of tax on behalf of an employee is usually considered a taxable benefit in itself which attracts an additional tax liability. ECA’s assignment management system, ECAEnterprise, automatically takes this “tax-on-tax” into account in salary calculations and cost projections.

Hypothetical tax

As hypotax is, by definition, hypothetical, its method of calculation is not enshrined in tax law and must instead be determined by company policy.

Instead of trying to replicate an employee’s individual circumstances based on home country payroll, 78% of companies use a standardised set of assumptions to calculate hypotax. A country’s standard rates of tax and social security contributions are applied, including the deductions, personal allowances and tax credits that are generally available to all taxpayers.

The assumptions are usually varied to take into account deductions or credits that are only applicable for certain family sizes. With this in mind, it is important to consider whether to include family allowance (child benefit) payments in hypotax calculations. In several countries these consist of a cash allowance. However, in many other countries they are built into the taxation system and received as a deduction from taxable income or as a tax credit. If you exclude cash family allowances from your calculations, assignees from certain countries may end up worse off.

Using a standard set of assumptions for all employees simplifies the hypotax calculation methodology, saving time and reducing costs for companies with large assignee populations while accurately estimating tax liability. It also ensures equity between employees and helps prevent assignees with similar gross salaries receiving very different assignment salaries for the same posting.

Advantages and disadvantages of tax equalisation

|

Advantages

|

Disadvantages

|

|

Makes assignments tax neutral

|

Can be expensive to administer

|

|

No financial surprises for the assignee

|

Onus on the company to be compliant

|

|

Encourages tax compliance

|

Potential assignee resistance unless policy well explained

|

|

Potential windfall for companies generated by assignments to low tax countries

|

|

Tax protection

Another approach used in the management of expatriate taxes is tax protection, where the assignee pays the lower of the home and host taxes.

According to the Expatriate Salary Management Survey it is much less common than tax equalisation, with only 7% of companies applying a tax protection policy.

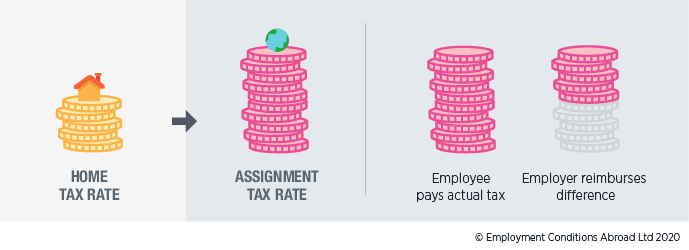

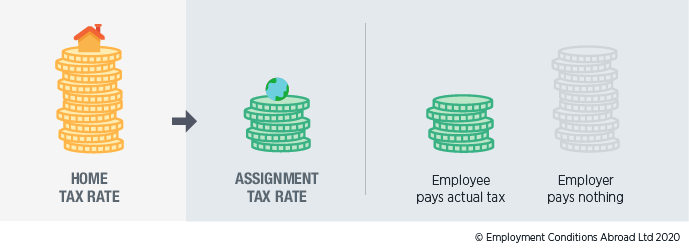

Unlike tax equalisation, the employee is responsible for paying all actual taxes due.

If the tax due in the host is higher than in the home, the employer will reimburse the employee for any excess tax.

If the tax is lower in the host the employee, rather than the company, keeps the difference.

Advantages and disadvantages of tax protection

|

Advantages

|

Disadvantages

|

|

Assignee can benefit from lower tax rates, which may be an incentive to undertake an assignment

|

May impede mobility and/or repatriation to higher-tax countries

|

|

No financial surprises for the assignee

|

Employer loses out on potential cost savings by allowing the assignee to keep the windfall

|

|

|

Assignee may experience cash flow difficulties

|

|

|

Potential compliance risk as the assignee may under-report the taxable income

|

Which approach should you use?

There are a number of factors to think about when contemplating your company’s tax management policy options.

For companies with only a few assignees, it may be easier to deal with tax on a case-by-case basis. This becomes impractical if you have hundreds of assignees, where a simple, standard procedure for managing tax differentials is essential for a smooth-running mobility programme.

Do you have the tools and resources to undertake complex hypotax calculations? If not, a simple, standard calculation methodology would be beneficial to the administrative process.

You should also consider the countries you operate in, and whether host country taxes are higher or lower than home country taxes. The bigger the differences, the more important an effective tax management policy will be, not least because it gives an indication of the tax burden the company might bear or the windfall they might receive.

Finally, tax compliance is an ever-present challenge in mobility, and any compliance failures by the assignee could reflect negatively on your company’s reputation. Moreover, failure to comply with the local tax law could result in expensive financial penalties being levied or the company being barred from doing business in that country. How high is the risk to your reputation should there be any compliance issues?

Conclusion

Both tax equalisation and protection are beneficial to assignees as they ensure that tax will not disadvantage them while on assignment. Under tax protection, they could even receive a cash windfall.

Whichever tax management policy you choose to apply, it will impact the total cost of the assignment, particularly when factoring in that any tax reimbursement is likely to result in a further tax burden itself. For the majority of companies, the tax equalisation approach at least offers the potential of cost savings to the company. This, in addition to removing tax as a barrier to mobility, is why it is used so widely.

FIND OUT MORE

Clear and comprehensive tax reports are available for more than 100 countries as part of a subscription to ECA data and can also be bought on demand.

ECA’s hypothetical tax data is built into our various assignment calculators and cost projections, including our assignment management system, ECAEnterprise. Our Tax Calculator enables you to calculate hypotax at the touch of a button, or alternatively we can run tax calculations on your behalf.

Please contact us to speak to a member of our team directly.