HEINEKEN worked with ECA to implement customised software to help run its global mobility programme, resulting in significant efficiency gains.

The successful delivery of the project has created immediate savings of time and costs. Higher accuracy rates have meant higher compliance, and less rework. Above all, time has been freed up for the team to work more closely with expatriates, and with HR colleagues across HEINEKEN.

”

Background

Internationalisation is at the core of HEINEKEN’s business strategy, and their Global Mobility programme has been pivotal to business growth and success. The number of international employees has risen steadily over the years, resulting in a strong need for robust data and insights on a variety of compensation and benefit elements, and a software system to manage their international compensation.

HEINEKEN has worked with ECA for data and support since 1976, and chose ECAEnterprise to run its Global Mobility programme, working with ECA to implement a customised version to calculate and manage salaries according to its own policies.

HEINEKEN's aims

- To create a streamlined process for expat remuneration calculation

- To automate the processes of salary calculations and cost-projections

- To provide timely and accurate expatriation cost overviews for the business

This was necessary in order to:

- Save time and increase efficiency in the process

- Achieve better compliance and reduce errors

- Free up time for the Global Mobility team to focus on interactions with expats

- Improve quality of expatriation cost overviews to enable better forecasting by HR and Finance

What the project entailed

ECA and HEINEKEN worked together to customise ECAEnterprise, implementing the following personalisations:

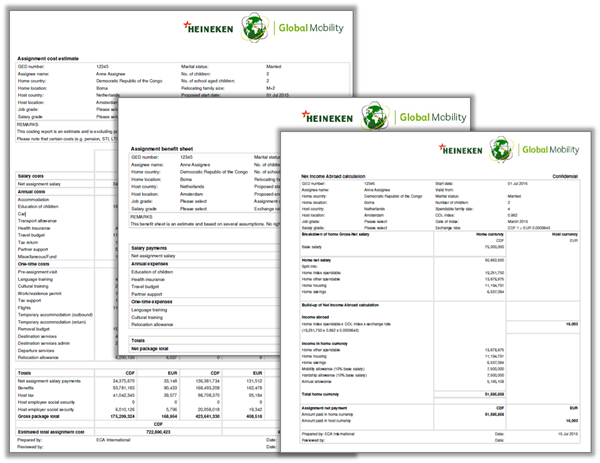

- Application of assignment policy rules for automation of salary and costing calculations including:

- Cost of living rules according to host country

- Spendable rules for split families

- Special rules for allowances based on age of children

- Dutch retirement allowance/pension rules

- Delivery ceilings for certain countries/entities

- Client-managed data tables for storage and application of HEINEKEN allowances and costing benefits values

- Retroactive calculations

- Automatically linking HEINEKEN’s defined regions and entities to ECA locations; styling reports, and implementing corporate terminology

Return on investment

- Overall: Improved management of the total compensation cost of international assignees. The implementation has afforded improved insight, better control, and higher compliance in this area.

- Global Mobility Department: The implementation of ECAEnterprise has yielded substantial savings of cost (4% of department budget) and time (about 80% for associated processes), helping the team focus on work that adds value to expatriates.

- International assignees: Through the improved format and presentation of the Net Income Abroad (NIA) overviews, the assignees have a better understanding of their pay and how it is arrived at. Their trust in the methodology is higher, raising their engagement during the assignment.

- Finance and HR/Talent Managers: Through the improved cost overviews and benefits overviews, and due to the fact that it takes only a fifth of the time to prepare that it did before, Finance and HR have an immediate understanding of the costs of the assignment. This helps in accurate budgeting and forecasting, as well as in determining a cost-benefit analysis at an assignment level.

Looking ahead

The success of this implementation will be leveraged in two ways within HEINEKEN:

- The project methodology will serve as a template for other technology implementations within Global HR.

- The benefits overview concept in ECAEnterprise will serve as a basis for a broader process around developing Total Reward Statements for all employees, not just expatriates.