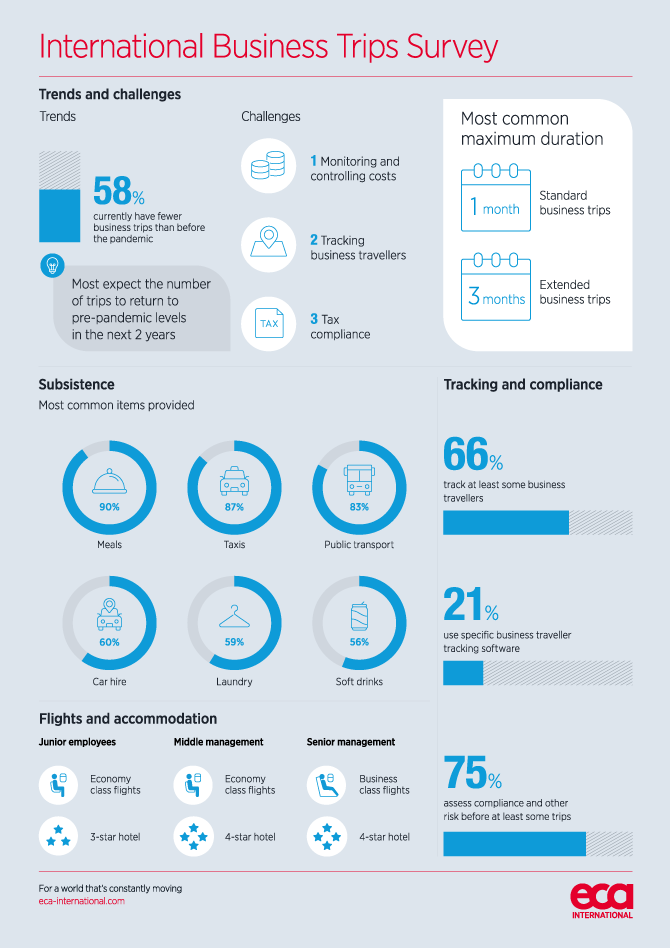

Like many forms of travel, international business travel was heavily impacted by the Covid-19 pandemic. ECA’s recent International Business Trips Survey found that over half of organisations currently have fewer international business trips than before the pandemic began, but most of these expect the number of trips to return to their previous levels at some point within the next two years as the ability to move across borders returns to normal.

Even after the turbulence of the past few years, the survey showed that many of the key elements of international business trips policy have remained consistent with pre-pandemic. In addition, the top challenges faced by those managing international business travellers – cost issues, tracking business travellers and tax compliance – are still the same, although sustainability is becoming increasingly important. The infographic below highlights some of the key findings of the survey, which covers the latest trends and best practice in paying, managing and tracking international business travellers.