Cost of living (COL) indices are designed to maintain an employee’s spending power when they are on an international assignment, while also ensuring that their home country housing and savings obligations can be met. ECA publishes a wide range of customisable indices for each available home to host combination to suit different policies and assignment objectives. Here we look at the options available and how to use them to manage assignment salaries effectively.

Applying the index

COL indices are most commonly used with the home-based method of calculating assignment pay, used by more than two thirds of the companies who took part in ECA’s Expatriate Salary Management Survey. To summarise from previous Mobility Basics posts, in this approach hypothetical tax and social security are deducted from the home country gross salary and the COL index is applied to a portion of the remaining net salary known as the ‘home spendable’.

When the COL index is applied to the home spendable this results in a host spendable that ensures the purchasing power in the home and host country will be equivalent. The host spendable is sometimes broken down into two separate elements in calculations, i.e. the home spendable and the Cost of Living Adjustment (COLA). It is important to highlight the fact that COLA is an adjustment and not an allowance, since its value may be negative. In other words, the home spendable may need to be adjusted up or down to maintain the same buying power in the host location as the assignee would have if they remained in the home location.

COL indices can also be used in other approaches to calculating assignment pay, such as the hybrid approach (see the basket approach and safety net variations) or the net-to-net approach. This latter method assesses the suitability of a local salary in the host location by comparing the local net salary against the home country net, taking the difference in living costs into account too. The type of salary approach used can affect the choice of COL index used.

Choosing an index type

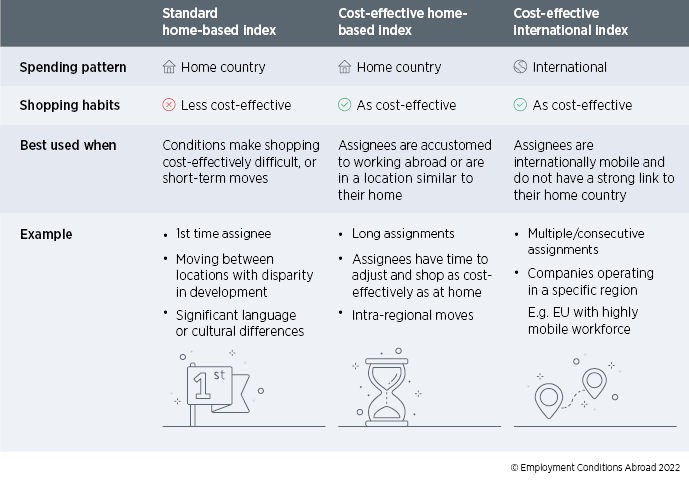

ECA publishes three different index types: standard home-based, cost-effective home-based and cost-effective international. These index types vary according to what type of spending pattern is referenced – what weight is allocated to items in the shopping basket – and according to the price levels that are compared between home and host locations. Spending patterns can reflect national (i.e. home country) or international trends, while comparing different price levels in the home and host takes into account how cost-effectively the assignee may be expected to shop on assignment. Indices may be higher or lower depending on the assumptions made.

Understanding the methodology behind our indices will help global mobility professionals select the most appropriate index for each policy, or type of assignment. The graphic below summarises the characteristics of our three index types and provides example scenarios for when each might be suitable.

As illustrated, different index choices may be more appropriate depending on factors like the length or location of the assignment and on the characteristics of the assignee. For example, a company may decide to apply a standard index in cases of long-term assignments to developing countries or to first-time assignees, but use a cost-effective index in net-to-net calculations for permanent transfers from one developed location to another.

Trends in index choice

Over recent years, companies have increasingly used cost-effective index types. One attraction is that cost-effective indices tend to be lower than standard ones, and therefore reduce the overall cost to the employer. Globalisation has also led to the increasingly wide distribution of similar goods and services around the world making it easier for expatriates to adapt to new shopping environments.

The location of an assignment is most often the deciding factor when choosing an index type, with the lowest, most cost-effective index types most likely to be used for moves between developed locations with similar shopping environments and the higher, less cost-effective index type more likely to be used for less developed locations and moves between different regions.

It may be no surprise that European-based organisations are those most likely to use the lowest index type, as the graphic below shows. Organisations headquartered in this region are likely to have a majority of assignments involve moves between developed nations and/or within the same region, for which lower indices are an appropriate choice.

© Employment Conditions Abroad 2022

Regardless of where organisations are headquartered, however, the standard home-based and cost-effective home-based index types are applied much more widely for assignments than our lowest cost-effective international index type. Both of these index types reference a home-based spending pattern and their wide use may indicate the continued importance of maintaining the assignee’s connection to the home country pay structure. Indeed, maintaining this link is the primary ethos behind using the home-based salary approach to calculate assignee pay – the pay approach for which COL indices are most likely to be considered.

Most organisations only use one index type for all cost of living calculations, but some companies find different index types to be the best fit for different kinds of assignments. In some cases we see companies set an initial index type for the start of an assignment and then switch the assignees onto another type later on in the assignment. If, for example, the home and host locations have very different shopping environments, the company might set the standard index type for the first year, and then switch assignees onto the cost-effective index type, based on the assumption that the assignees will have adjusted better to shopping in the new location by then.

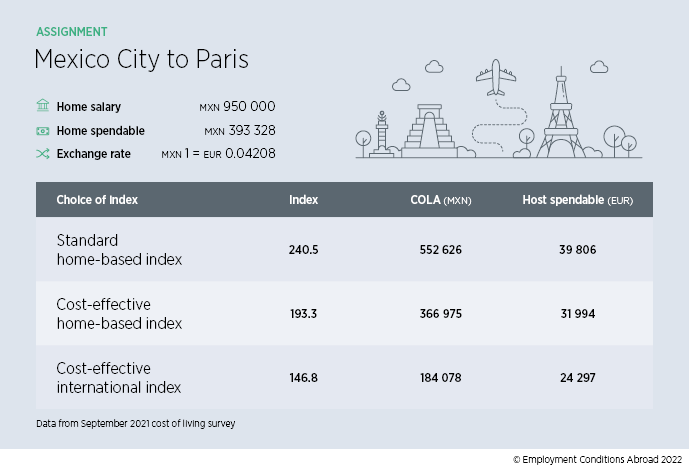

The choice of index can have a substantial impact on the overall assignment cost, as demonstrated by the example below. When selecting which index to use it is worthwhile considering not only which one would be most applicable for your assignees, but also whether unnecessary costs can be avoided for the company.

Customise your basket

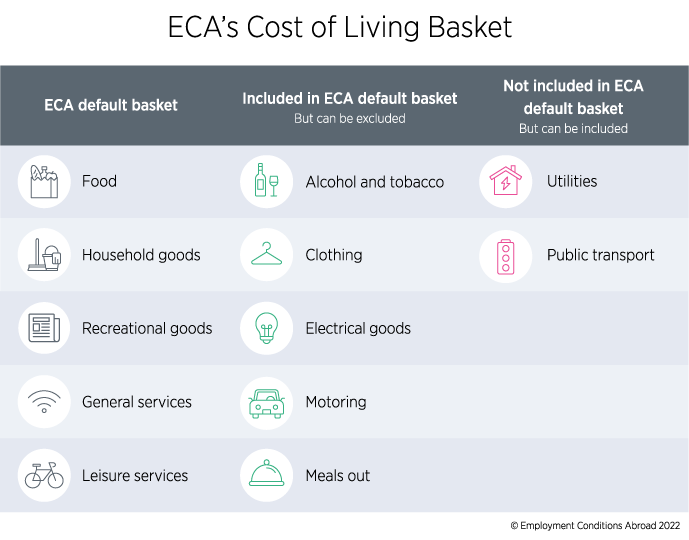

ECA’s indices compare spending on over 170 basic goods and services, but there are circumstances where companies may require some groups of expenditure to be added to or excluded from the index calculations. This may be because the company covers some costs through separate allowances or deems some types of expenditure to be unnecessary for the specific assignment.

For example, an assignee may be provided with a car and driver by their employer and thus the motoring group may be excluded. Exclusions can also be a result of the shopping environment. For instance, if the clothing available in the host location is not of a suitable standard for expatriates, then the clothing group may be excluded.

ECA’s Cost of Living Calculator allows companies to tailor their index to their policy by including or excluding specific groups of expenditure.

It is important to remember that adding an expenditure group will not always result in a higher index, nor will excluding a group always lower it. For example, for an assignment from Prague to Istanbul in our September 2021 Cost of Living Survey, the standard index without utilities is 105.7. When utilities are added to the calculation, the index drops to 95.5 because utilities costs in Istanbul are a lot cheaper than those in Prague. So, despite adding in an expenditure group, the index has not only gone down but moved from being positive to negative.

Final thoughts

Given the number of options available to adjust their COL index, it is perhaps surprising that many companies adopt a one-size-fits-all approach. While this promotes consistency, is it realistic to assume that all assignments are the same? Nobody would advocate the complexity of individualised COL indices but equally not all assignees have the same needs. As mobility policies are increasingly segmented – whether it is developmental moves, expat light policies, global nomads, or a traditional long-term assignment – indices can be tailored to suit these different business needs.

Understanding the various ways in which a COL index can be calculated can greatly help any global mobility professional. Making sure that your choice of index suits your organisation’s business needs and culture and can be clearly explained can go a long way to managing assignee expectations – even helping to head off questions about cost of living adjustments before they arise. Having a clear, defensible policy that covers all eventualities will ensure your assignees’ pay is subject to an appropriate COL index calculation methodology.

FIND OUT MORE

Please contact us to speak to a member of our team directly.