While the home-based approach maintains its position as the dominant method for calculating assignee salary packages, global mobility professionals are looking at other ways to compensate their increasingly diverse expatriate populations. One method that often attracts a lot of attention is the local-plus approach.

What is the local-plus approach?

In our previous Mobility Basics blogs, we have looked at the host-based approach on a few occasions. We’ve considered expatriates being compensated based on a purely local salary in line with local nationals, and a local salary based on the expatriate market rate. Here we take a look at the local-plus approach.

The local-plus approach is a type of host-based salary system, and the concept is quite simple. The assignee receives a salary that is based on the local market rate of the host country, plus additional benefits or allowances that are not typically provided to local nationals. It is often associated with one-way transfers, localisations and locally hired foreign nationals. However, it can also be used – in some cases – as a suitable alternative to the traditional expatriate package.

According to the results of the 2018 Expatriate Salary Management Survey, the most common benefits provided under local-plus are relocation assistance, housing allowances and home leave trips, with other typical benefits detailed below.

© Employment Conditions Abroad 2019

As with other host-based approaches, the salary is typically delivered in the host country currency, and the assignee is usually responsible for all tax liabilities.

When should you use the local-plus approach?

There are a number of reasons a company may wish to use the local-plus approach. One of the main motives to put an assignee on a local salary is to achieve equity between peers in each host location. Ensuring your assignee receives the same base salary as their local peers prevents situations arising where two employees on the same job level, doing the same job, receive different salaries because of their nationalities. However, putting an expatriate on a purely local salary may not be sufficient to compensate for the additional costs they have to bear compared to local employees, such as ongoing home housing costs and international schooling fees. These are among the reasons why over 70% of companies using a host-based approach opt for the local-plus method. By providing the ‘plus’ elements, companies are still able to achieve equity while at the same time recognising that there are differences in circumstances between expatriates and local nationals.

Another key reason why companies choose to use this approach rather than the home-based is to reduce costs. If the host salary is similar to that of the home country, a local salary with a limited set of benefits can lead to savings for the employer. As well as a reduced number of benefits, the allowances are typically of a lower value than the same benefits provided by companies for assignees on the home-based approach. The idea is that the expatriate should be able to ‘live like a local’, so companies will often provide lower housing allowances for example. Furthermore, for self-initiated moves or junior employees going on career development assignments, the experience alone may act as an adequate incentive. Thus, they may be more likely to accept a local offer with limited benefits as opposed to a full expatriate package, as compensation is not their main motivator.

It is important to note that these ‘plus’ elements are not necessarily paid continuously throughout the assignment. If the post is a permanent move, the additional benefits are often provided at the start of the assignment to aid the employee with the transition. Companies will also phase out the benefits when localising the assignee to ease the transition from an expatriate package to a purely local one. Similarly, the level of the benefits can be reduced as the assignee becomes more accustomed to their host location. Therefore, companies can also make cost savings in this respect.

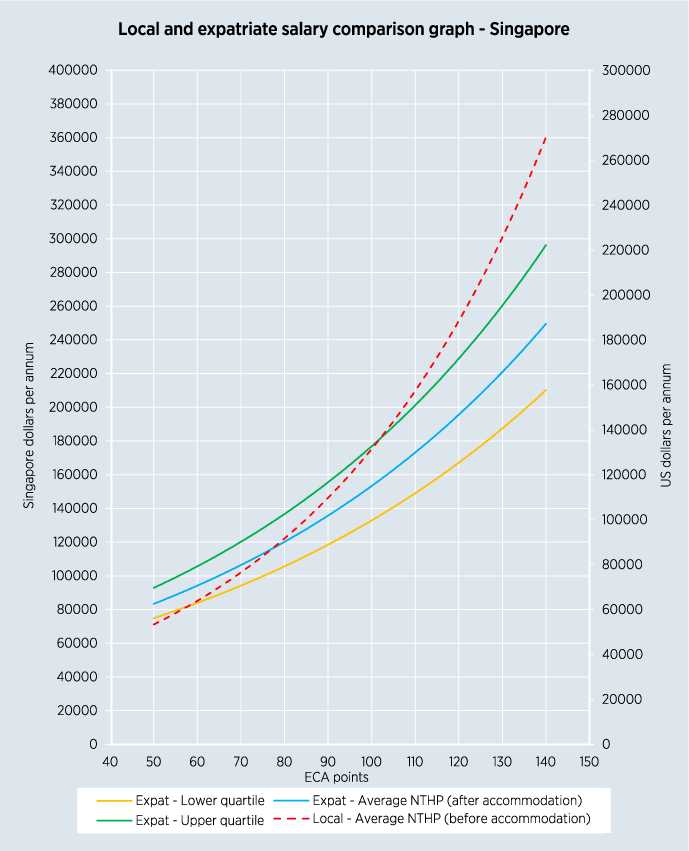

However, cost savings may not be achievable in all situations. In the case of Singapore, for example, as you can see from the findings of our MyExpatriate Market Pay Survey below, the local salary quickly exceeds the lower quartile of the expatriate market rate, and from 105 ECA job points, overtakes the upper quartile at an exponential rate. Therefore, companies should always consider the specific host location and seniority level before assuming that the local-plus approach will be a cost-effective solution.

In order to evaluate whether a local salary will suffice, it is important to not only consider the gross salary, but also the net amount the assignee will actually take home. On a gross level, the assignee may be better off on a local contract compared to their current home gross salary. However, if the level of tax and social security is high enough to result in a lower net than they enjoyed at home, they will most likely reject the offer. Therefore, most companies will run a net-to-net calculation to assess whether a local salary would be suitable. After the net incomes are compared, one very important factor to also consider is the difference in the cost of living between the home and host locations. If the employee bears the burden of any reduction in purchasing power, using the local-plus approach can lead to a perception of ‘good’ and ‘bad’ host locations. The inability to attract assignees to ‘bad’ locations could potentially be a significant obstacle to meeting business needs and objectives.

If we take the examples below from ECA’s National Salary Comparison, on a purely net level, a middle manager going on assignment from the United Kingdom to either Hong Kong, France or Denmark will be better off on a local salary and would therefore most likely accept the package. However, when we add their relative buying power into the mix, moving to France and Denmark on a local contract may not be as appealing as it initially seemed, as they will be worse off compared to their home location.

© Employment Conditions Abroad 2019

Depending on the nature of the assignment, i.e. whether it is a strategic move or self-initiated, the ‘plus’ elements may be a way of incentivising the assignee to accept the package by making it more attractive, as cost of living adjustments are not typically provided to assignees on a local-plus policy.

Summary

By topping up the local salary, the barrier to mobility is alleviated. There is a potential for the company to cut costs, as the local-plus approach can be seen to be a reasonable compromise between full localisation, which can be difficult to achieve, and the expensive traditional expatriate package. Below are some additional advantages and disadvantages associated with this approach. However, it is important to remember that there is no one-size-fits-all policy, and while the local-plus may be a perfect solution for particular locations and circumstances, it may not be ideal for your entire expatriate population.

|

Advantages

|

Disadvantages

|

|

Equity with host-country peers

|

Purchasing power is not protected

|

|

Can be more cost-effective

|

In some situations, it may be more expensive

|

|

Easier to administer

|

Hard to repatriate as link is severed with home country

|

|

Enables a degree of localisation

|

Creates ‘good’ and ‘bad’ assignments

|

FIND OUT MORE

ECA’s MyExpatriate Market Pay reports provide an in-depth and personalised guide with which to compare your current expatriate salary and benefits policies against 10,000 jobs across a wide range of industry groups in 130 countries around the world. Participants receive free country-specific benchmarking reports for each country that they submit data for.

Do you need to establish a local salary for your international assignee or international new hire? Our net-to-net calculation is exactly what you need if you want to protect your employee’s current spending and saving power.

Please contact us to speak to a member of our team directly.