Global expansion and greater workforce diversity over the last decade have made it more challenging than ever to achieve equity, and increasingly companies are including a more diverse set of approaches to remuneration in their toolkit. In previous Mobility Basics blogs we have looked at the two most common ways of calculating expatriate pay, the home-based approach and the host-based approach. This blog post looks at an alternative that harnesses the best of both methods; known as the hybrid approach. It is an approach used at least some of the time by 18% of companies who took part in ECA’s last Expatriate Salary Management Survey.

What is the hybrid approach?

The aim of the hybrid approach is to maintain the assignee’s link to their home country, while ensuring they have sufficient spendable income on assignment by making it equal to that of their host-country peers.

Home-based approach

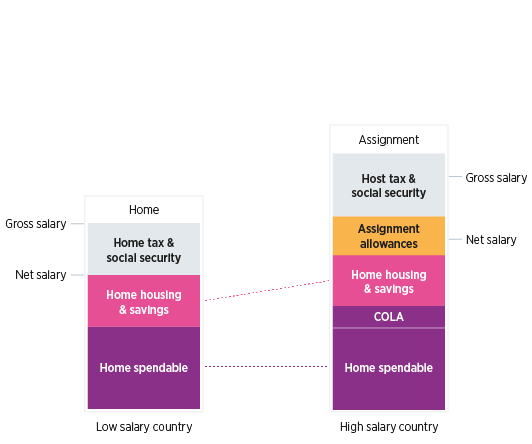

The hybrid approach is a modification of the home-based approach. Under both approaches, the starting point is generally the notional or hypothetical home country gross salary, from which hypothetical home tax and social security contributions are deducted. Companies then use spendable income tables to calculate how to split the home net salary into housing, savings and spendable income components.

Under the home-based approach, the home spendable is usually protected for differences in living costs by applying a cost of living index to produce the host spendable (i.e. home spendable +/- COLA). This is the starting point from which the assignment salary in the host country is built up. The savings and housing components are added back on, and assignment allowances are often awarded (i.e. mobility allowances and location allowances are common). The assignment net salary is grossed up for host country taxes and social security contributions to arrive at an assignment gross salary.

Disadvantages of the Home-based approach

However, the home-based approach isn’t always suitable. When moving assignees from low- to high-salary countries, the host spendable calculated using the home-based approach may not be sufficient to support the assignee’s expenditure in the assignment location. This can also be true for moves from higher-salary countries with high levels of taxation, meaning that the build-up is starting from a low base. Even applying a very high cost of living index might not get the host spendable anywhere near local peers’ spendable levels.

Paying a host-based salary, i.e. the market rate in the host country, is an option, however the host-based system may make repatriation challenging if returning to the home country salary structure after the end of an assignment means a significant pay cut.

Hybrid approach

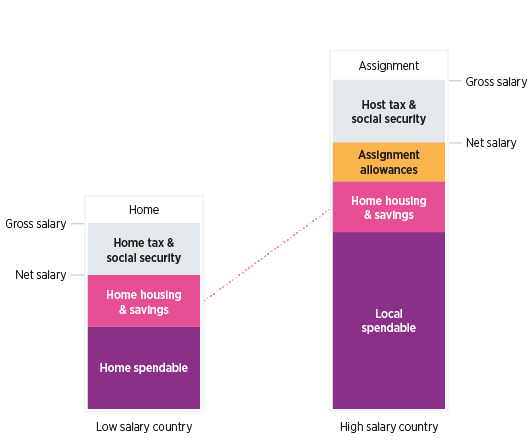

Using the hybrid approach combines the best parts of each system – it brings the assignee’s purchasing power level with that of a local peer, while still linking discretionary income to the home country.

1. Rather than calculating a host spendable by adjusting the home spendable for cost of living differences, under the hybrid approach the host spendable is linked to the spendable of local peers. There are three stages to calculating the local spendable:

2. Companies refer to their pay scales to define the gross salary that would be paid to a local individual in the host location for the role in question.

3. Hypothetical host tax and social security contributions are deducted to calculate a local net salary figure.

To calculate the portion of the local net salary that is spendable income, companies can either refer to spendable income tables available for local nationals of comparable job level, or they can simply calculate a fixed percentage of local net pay.

As with the home-based approach, the housing and savings elements are added back on to the host spendable along with additional allowances to make up the net assignment salary. Employees of similar seniority assigned to work in the same location will all receive equal host spendable payments, but the housing and savings portions of their income will still differ according to the home countries from which they’ve been assigned.

Variations of the hybrid approach

Basket approach

A variation of the hybrid approach is the ‘basket approach’, which uses a spendable based on the salaries of several countries rather than just that of the host.

To calculate the basket spendable, home spendables for the same job level are calculated for different nationalities (typically reflecting the company’s expatriate population), and a cost of living index applied to each. The resulting host spendables are converted into the host currency and averaged to give the final host spendable.

This method not only ensures that expatriates working in the same host country receive the same spendable, but that the spendable reflects the living standards of assignees from all the countries in the basket.

Safety net

Another variation is to use the hybrid approach as a ‘safety net’ when the home-based approach does not produce a sufficiently high assignment salary, which can be particularly useful when assigning employees from countries with a relatively low local salary structure.

Companies run a standard home-based approach calculation, and compare the host spendable (the home spendable adjusted for cost of living differences) with the local peer spendable. If the local peer spendable is lower than that produced using the home-based system, then a salary based on the hybrid approach would be unattractive and the home-based system should be applied as usual. If, however, the local peer spendable is the higher of the two, then the hybrid system is applied.

This approach allows companies to have an insurance policy for their home-based approach that ensures that their assignees’ minimum living standard will not be lower than that of their peers in the host location.

Market rate adjustment

So far we have only considered cases where companies take a hybrid approach to protect their assignees’ living standards. However, a minimum salary in the host location can also be stipulated by local immigration authorities. For example, an assignee applying to work in the Netherlands as a highly skilled migrant must be paid a minimum gross salary. If a company wants to send an assignee to the Netherlands on a home-based salary from a low salary country, they may find the assignment salary falls short of what is required.

What companies can do is calculate the minimum salary requirement in net terms, to compare with the net assignment salary produced from the balance sheet calculation. If the net assignment salary is the lower of the two, the shortfall can be made up by adding a ‘market rate adjustment’ to the package. This allowance will bring the gross package up to the required minimum, without losing the link to the home country compensation structure.

Why use the hybrid approach?

Cost saving

For moves from a low-salary to high-salary country where the home-based approach does not provide sufficient compensation, this system may be a more cost-effective way of raising the salary to an appropriate level than the host-based approach.

Easier re-integration

The host-based approach can make repatriation unattractive if the employee would be returning to a lower-salary home country. As the housing and savings element and assignment allowances are calculated as they would be using the home-based approach, the hybrid approach maintains the link to the compensation structure in the home country. From a financial perspective, this may facilitate the transition back to the home country.

Fairness

Applying a local spendable ensures that all peers receive the same host spendable, and therefore standard of living, regardless of country of origin. If a basket approach is used then the standard of living will also reflect that of all nationalities in the basket, whichever host country they are working in.

Promotes mobility

The assignee’s living standard should be sufficient, regardless of which location they are assigned to. This helps to prevent “good” and “bad” postings emerging in companies that operate in a broad range of countries.

When should you use the hybrid approach?

From low-salary to high-salary countries

When moving assignees from low- to high-salary countries, the host spendable calculated using the home-based approach may not be sufficient to support the assignee’s expenditure in the assignment location. This can also be true for moves from higher-salary countries with high levels of taxation, meaning that the build-up is starting from a low base. Even applying a very high cost of living index might not get the host spendable anywhere near local peers’ spendable levels.

Paying a host-based salary is one solution. However, the host-based system may make repatriation challenging as discussed above. Using the hybrid approach combines the best parts of each system – it brings the assignee’s purchasing power level with that of a local peer, while still linking discretionary income to the home country.

Likewise, falling short of a minimum salary requirement of the immigration authorities in the host country is most likely to happen when the assignee’s home country has relatively low salaries. In this scenario, using a market adjustment rate brings the assignee up to the required salary, while still retaining the link to home country compensation.

Fixed-term assignments

As with the home-based approach, the link with the home country salary structure makes the hybrid approach more suitable for assignments where the employee will return home, rather than for permanent transfers or global nomads who move from one country to the next without having a designated home country.

To achieve equity with other assignees

Unlike the home-based approach, assignees from different countries receive the same spendable amount in the host country – although their levels of total pay will differ.

Summary of the hybrid approach

When the home- and host-based approaches fall short, a hybrid approach that combines aspects of each can be a useful solution in the right circumstances. It is, however, complex and not appropriate for all moves; whether or not it is the right choice for your organisation depends on the mobility you need to achieve and the demographics of your assignee population.