Global mobility (GM) teams are increasingly faced with the challenge of having to manage a wider variety of methods of international working in order to support business demands for agile staffing, and employee demands for greater flexibility. The Covid-19 pandemic has amplified these demands. Remote international working has come to the fore in the pandemic out of necessity, but even as international travel opens up and more international relocations are able to go ahead, some teams might find that the business and its employees have an appetite to keep remote working arrangements in the mobility toolkit. Added to these challenges, a tough economic climate puts added pressure to reduce, or at least contain, costs. All of this means that more and more companies are exploring alternative ways to compensate their different cadres of mobile staff.

Salaries based on local packages are becoming increasingly common. Using a local salary as a base when calculating a package for a permanent transfer or an international hire usually seems to be a sensible approach – i.e. when equity with peers in the host location is thought to be more important or relevant for the business than maintaining links with the pay levels and peers in the home country. In the case of remote workers working from another country while continuing their role in the home country, maintaining the home salary may generally seem to be the logical way forward. But a local salary could be more appropriate in some cases, especially if a lack of equity with local peers becomes an issue – this could be the case if, for example, the remote working arrangement is permanent, or if the employee will be working very closely with peers in their new country of residence. Sometimes a local salary is even considered for more traditional long-term assignments – particularly if this is expected to reduce administrative burden on the business, or better incentivise employees.

As we recently explored in our National Salary Comparison whitepaper – which compares local salaries and relative buying power for managers across 58 countries – offering a local package comes with its own challenges. A local package could result in a lower purchasing power than the employee enjoys in their current home location, making it an unattractive offer. On the other hand, in cases where the business intends to repatriate the employee, a huge leap in purchasing power may make it impossible to incentivise a return to the home location at the end of the assignment or remote working arrangement.

Understanding what level of buying power a local-based salary will give is vital to ensuring that the package offered will be fair and provide sufficient incentive for the employee to take the position. ECA’s Net-to-Net Calculator provides a simple way to do this, and to see the adjustments required to redress any shortfall.

How the Net-to-Net Calculator works

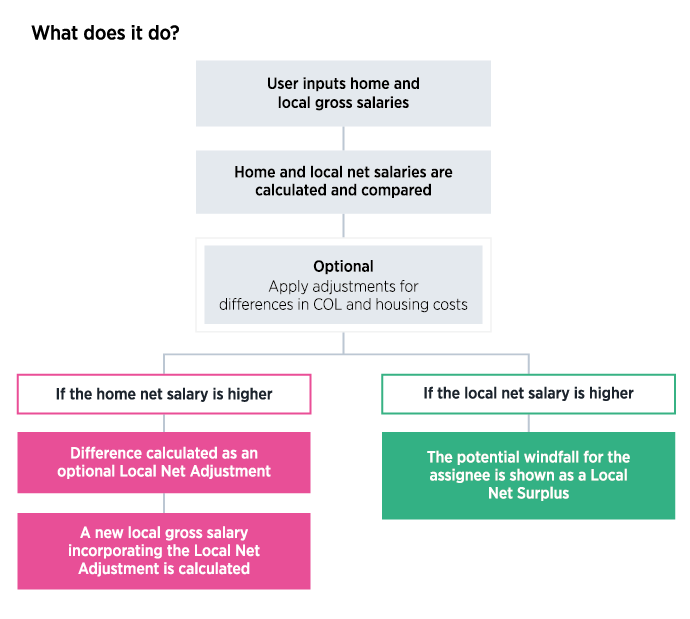

Developed in response to client requests, ECA’s Net-to-Net Calculator is an easy-to-use tool that automates the processes that many companies would otherwise have to do manually in order to assess the suitability of a local salary. It provides the tools that GM professionals need in order to negotiate and explain a local salary offer to their employees in clear terms.

The beauty of the Net-to-Net Calculator is its simplicity. You don’t have to input hundreds of numbers; only the home and local gross salaries are required. The calculator then deducts the appropriate tax to provide a comparison of net salaries.

This level of comparison may already include as much information as you need, but net-to-net means different things to different people, and a level of pragmatism in the application of a local-based approach is expected.

ECA’s Net-to-Net Calculator, therefore, also gives you the option to factor cost of living and housing differentials into the comparison. Even though a local salary is being offered, the employee is unlikely to be a national in the host location, and you may wish to take into consideration the employee’s standard of living in the home country, as well as a lack of familiarity with local living costs and the housing market, when calculating a salary package.

The results of the comparison and associated factors, where selected, are presented in a comparison report, clearly showing how the two salaries measure up.

Key uses for the Net-to-Net Calculator

Demonstrating the value of a salary - When a salary offer is refused or challenged, it can be difficult for GM professionals to demonstrate the true value of the proposed salary without providing a calculation that clearly illustrates the variables at play in a home to local salary comparison. The clear, side-by-side layout of the report produced by the Net-to-Net Calculator, with the figures presented in both currencies, makes it simple to see.

Protecting home country buying power - While the local salary offered to employees may seem perfectly acceptable since it is appropriate for peers in the host location, you may want to assess the impact that a different tax regime, lack of familiarity with the local living costs and a different housing market will have on the employee’s spending power. If the net-to-net comparison shows comparable income, then the company has something to share with the employee to demonstrate that they are not worse off. If the comparison shows a reduction in the employee’s spending power, the net-to-net comparison will suggest the minimum top-up the employee would need in order to offset the shortfall.

Revealing the wider picture - The Net-to-Net Calculator puts net salaries into context and provides a useful check where preconceptions may exist. For example, if the host location has a favourable tax regime, it is easy to assume that a local salary offer will be suitable – and a comparison of the home and local net salaries would confirm this. Adding a housing differential could, however, put into doubt the viability of a local salary offer if the local housing market is particularly expensive.

Testing a new policy design - Another scenario where net-to-net comparisons can prove extremely useful is when companies want to gauge the impact of changing their remuneration policy from a home-based system to a host-based system. Running net-to-net calculations will test the viability of the proposed reward approach. In the case of restructuring or significant organisational change, where a company is considering switching a group of employees to local T&Cs, the Net-to-Net Calculator can help establish if the proposed package would work.

Net-to-Net Calculator in action – a case scenario

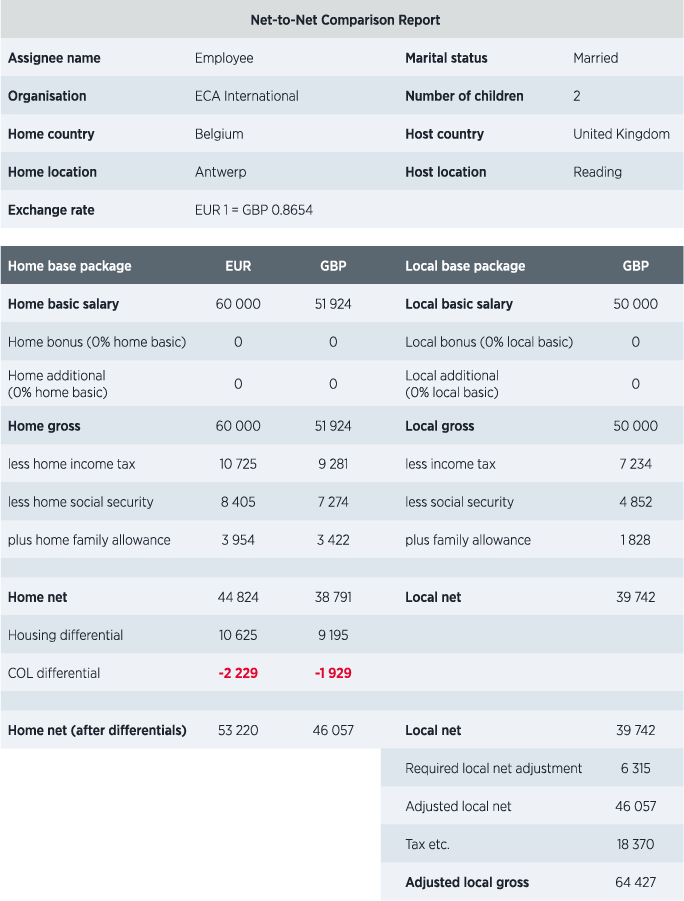

The starting point is an employee from Antwerp, Belgium, on a home salary of EUR 60 000, whose company is sending her to Reading, UK. She is to be accompanied by her spouse and two children. The local salary on offer, based on their local salary scale at this employee’s job grade, is GBP 50 000. To assess the viability of this salary offer, the company runs a net-to-net calculation.

After home and local gross salaries are inserted, these are netted down and the two resulting net salaries are compared – for this reason, the home salary values are converted from EUR to GBP. The local net salary of GBP 39 742 is higher than the home net salary of GBP 38 791. If the comparison stopped here, the calculator would display a small local net surplus of GBP 951. However, the company wishes to also take into consideration how different living and housing costs may affect their employee in Reading. Simply by switching on the housing and cost of living (COL) differentials in a dedicated tab, this additional level of comparison is easily achievable in the Net-to-Net Calculator. The ‘Net-to-Net Comparison Report’ below illustrates the outputs produced by this net-to-net calculation.

In this example, we consider the housing and COL differences between Antwerp and Reading. While Reading has lower living costs, this is far outweighed by the higher housing costs, and the employee needs GBP 46 057 (home net - after differentials) to maintain their home country buying power, rather than GBP 38 791 (home net salary). In other words, expanding the comparison to include the housing and COL differentials has highlighted that simply providing the local net of GBP 39 742 may not be an appealing option for this employee, and that an adjustment may be required. The ‘Required local net adjustment’ of GBP 6 315 is clearly displayed, together with the ‘Adjusted local net’ and the corresponding ‘Adjusted local gross’.

The net-to-net calculation is indicating that a local gross of GBP 64 427 would be required in order for the employee to maintain their home country buying power, rather than the originally suggested GBP 50 000.

How to buy the Net-to-Net Calculator, individual calculations or software functionality

The Net-to-Net Calculator can be added to ECA subscriptions for access within MyECA, and activated for your authorised users in a matter of hours. If you only have an intermittent need, net-to-net calculations are also available to both existing ECA subscribers and nonsubscribers through our Client Services and Consultancy services.

Net-to-net calculations can also be incorporated into ECAEnterprise, ECA’s Assignment Management System, for companies who have a net-to-net policy framework in place, or who regularly use net-to-net comparisons as a step to establishing the most appropriate remuneration approach.

And don’t forget - ECA’s latest whitepaper, National Salary Comparison, compares local salaries for managers in 58 countries in terms of relative buying power, showing at a glance which international moves will be viable on local terms.