Russian forces started assembling on Ukraine’s eastern border in spring 2021 leading to concerns it would be the prelude to a Russian incursion into Ukrainian territory, like those in 2014. Some felt that this was Russian president Vladimir Putin looking to test NATO unity with what he insisted were merely military exercises. However, as the build-up continued in early 2022 intelligence agencies became increasingly concerned that a full-scale invasion was the intention, especially when military units also began to mass on the border in neighbouring Belarus. On 24 February these fears were realised as Russian forces advanced into Ukraine, attacking the country on multiple fronts.

Events since have posed huge challenges to companies with expatriates based in Ukraine, which has suffered major damage and loss of life. However, it is not just expatriates in Ukraine who have been affected by the war. As the aggressor in the conflict Russia has been hit with a range of economic and diplomatic sanctions by many countries, leading to increases in the cost of living and reduced access to international banking and foreign currency and other goods and services. The situation on the ground in Russia has become more uncomfortable for expatriates based there.

Belarus has also been hit by sanctions because of the regime’s continued support for Russia, President Lukashenko being a longstanding ally of Putin and allowing his country to be used as a staging post for Russian soldiers to enter Ukraine.

Though the situations facing companies in these countries are linked by events they pose very different challenges. In view of this, we carried out a spot survey to establish exactly what actions organisations have been taking in Ukraine, Russia and Belarus. Here we look at some of the findings and how ECA can help.

Ukraine

In Ukraine, organisations and expatriates have been following advice from governments all over the world – leave as soon as possible for reasons of personal safety. Indeed, a large majority of companies have evacuated essential and non-essential expatriate staff, along with their dependants. It is notable that over half of companies have also arranged for some local nationals to leave the country such is the extreme nature of the security situation. However, only just over a third of organisations have closed operations in Ukraine or are planning to close them.

Very few organisations have increased or introduced allowances in Ukraine – just 3% have increased the location allowance, and only 11% the cost of living allowance. Such low numbers are understandable given these allowances would not account for the risk to life of staying in Ukraine at the current time. Additionally, most assignees have already been evacuated, so practical measures are much more appropriate. Furthermore, any interim allowance could quickly become out of date given the fluid and fast-moving nature of events. There is also the administrative burden for global mobility teams of reviewing allowances outside annual salary reviews.

However, if the situation in Kyiv improves sufficiently for assignees to begin returning (as some are planning to at the time of writing) then an interim review of the location allowance would be appropriate and ECA has updated location ratings data for Kyiv available on request. The updated assessment reflects, for example, the damage to infrastructure, reduced access to goods, services and medical supplies and the lack of flight availability. Kyiv’s location ratings will be reassessed again in the coming months as part of the annual location ratings survey update, with the new score published on the ECA website in mid-November.

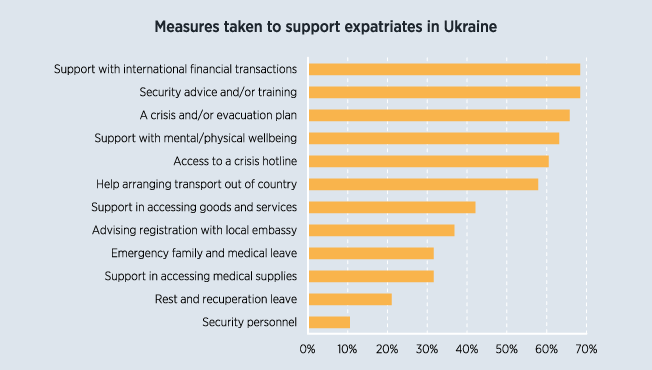

The location allowance should never be considered an incentive to encourage expatriates to take assignments in dangerous locations and other non-financial measures should be taken to support expatriates in Kyiv, as part of a formal crisis policy/evacuation plan. Survey responses indicate that the most common measures taken to support expatriates in Ukraine are support with international financial transactions and security advice and training, over two thirds of companies having introduced such measures. Other options offered by over half of respondents are support with mental health/wellbeing, access to a crisis hotline and arranging transport out of the country.

For staff leaving Ukraine a large majority of companies have continued to offer employment benefits and arrange accommodation. 60% have offered support with financial transactions.

Russia

The situation in Russia has posed a different challenge to organisations and their international assignees. Russian cities have not been subjected to military assault and bombardment, unlike those in Ukraine. However, the imposition of a wide range of economic and diplomatic sanctions have hit the Russian economy hard, with expatriates seeing significant increases in the cost of living and shortages of some goods and services.

While just over a quarter of organisations have closed or are planning to close operations in the country, almost two-thirds of companies have evacuated all expatriate staff. This may well be in response to the impact of sanctions and the shortages of foreign currency, goods and services these have caused. International financial transactions have also been made impossible.

Another explanation for the high number of evacuations from Russia is that they are a precautionary measure against any future change in policy and atmosphere in the country given the threat of martial law or concerns over reprisals against foreign nationals, especially those from NATO countries and others imposing sanctions on Russia. Where staff have left Russia a large majority of companies have continued to offer employment benefits, with almost three quarters helping to arrange accommodation and just over half providing support with financial transactions.

Fortunately, only 12% of companies reported that their expatriates have received direct anti-foreigner sentiment (a very similar number to those in Ukraine), though this number may increase if the impact of sanctions worsens.

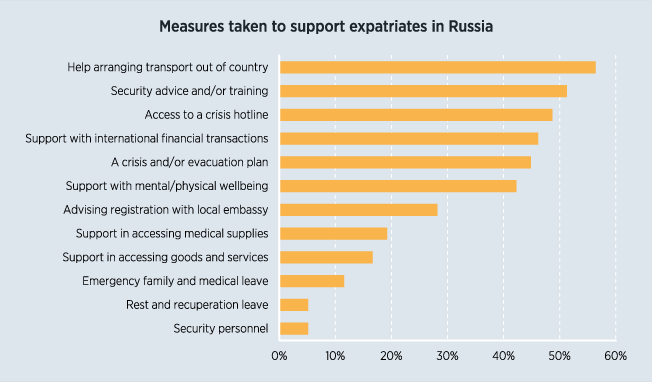

Only 17% of organisations in Russia have provided support in accessing goods and services, indicating that sanctions are not significantly impacting on expatriates so far and that supply chains are largely holding up, despite price rises and the weakness of the rouble. However, the proportion of companies offering support with international financial transactions is considerably higher, being almost half. The only measures offered by over half of organisations are help with organising transport out of the country and security advice and/or training.

Just 6% of companies have adjusted the cost of living allowance for Russian locations. ECA will publish cost of living indices in May which will take into account the initial rise in prices and depreciation of the rouble.

Less than 10% of organisations have introduced or increased the location allowance – partly as many have left the country, but also as despite the sanctions everyday life is largely the same as before the sanctions. We do not advise updating the location allowance for Russian cities at this time because while there are shortages of some goods such as sugar and buckwheat, and difficulties with the banking system exist, quality of life has not yet significantly worsened. There is no noticeable increase in physical threat to assignee safety, and it is still possible to fly to international hubs, though the number of flights and destinations has reduced.

Providing practical support for assignees to manage the impact of the sanctions has rightly been the focus for organisations with staff remaining in Russia. However, ECA will continue to monitor events on the ground closely in case an interim assessment for location ratings in Russia becomes appropriate, and will survey prices in the country more regularly if inflation remains an issue. All location ratings are updated on an annual basis, so the advice for Russian cities will be updated later in the year taking into account all events leading up to that point.

Belarus

Considerably fewer organisations have a presence in Belarus compared to Ukraine and Russia. The sample received for the spot survey was therefore small, making it difficult to draw conclusions from the data. However, there are still some points of interest to be obtained from the responses.

For instance, half of organisations here have not carried out any evacuations at all and have no plans to do so. It is therefore unsurprising that only one company has closed operations in Belarus. Few companies have provided support such as assistance with accessing goods and services or international financial transactions.

No companies in Belarus indicated that they have received reports from their assignees of anti-foreigner sentiment. Given these findings, it would appear the impact of sanctions is limited in Belarus at the current time, perhaps even less so than in Russia.

Conclusion

The situation in Ukraine and the surrounding area is extremely volatile and is likely to remain so in the foreseeable future. The crisis ebbs and flows daily, posing huge challenges for decision making by global mobility teams, not just those in Ukraine but also in Russia and Belarus where the impact of sanctions causes difficulties for those expatriates who remain. Whether the situation improves or deteriorates, it is important for companies to have a formal crisis policy in place so that expatriates can be supported effectively and efficiently. However, the spot survey revealed that over a third of companies still do not have one.

Companies are, so far, taking more practical measures to help their assignees in Ukraine, Russia and Belarus rather than employing the short-term fix of simply increasing allowances and payments. Practical assistance remains the priority, though ECA does advise updating the location allowance for any assignees returning to Kyiv. We will continue to monitor the situation and remain on hand to offer updated advice and assistance with any questions you may have.

FIND OUT MORE

ECA will soon publish updated cost of living data for Russia and Belarus and for those with assignees remaining in, or returning to, Ukraine we have updated location ratings information available. However, the situation is changing regularly so please contact us for the latest advice on managing assignees in these countries. If you would like to purchase the "Conflict in Ukraine" spot survey report, please get in touch with your usual ECA contact.

Global Expat Pay, a close partner of ECA, can also support companies with assignees affected by the financial and payroll issues raised by the conflict in Ukraine and the sanctions on Russia. They offer solutions including support with employee payments and payroll remittance, through their partnership with Western Union Business Solutions and HSBC Expat. This has recently proved particularly useful for displaced employees from Ukraine who may have no bank accounts in their current location and those struggling with spending power due to currency-related issues.

Please contact us to speak to a member of our team directly.