When it comes to the application of cost of living indices, the aim is always to protect the assignee’s purchasing power in the assignment location, making sure they are neither better nor worse off than if they had stayed in the home country.

We live in a fast-paced world where economies are constantly evolving: as a consequence, the Cost of Living Adjustment (COLA) will always be a snapshot of the circumstances at the point the data was collected. Almost like a real photograph, it has the ability to capture and “freeze” a specific moment in time, and as a consequence it might not necessarily align with what is perceived daily by the assignees on the ground.

There are always two factors that impact the index: exchange rates and price changes of the ECA shopping basket in both home and host locations (the relative inflation).

Exchange rates

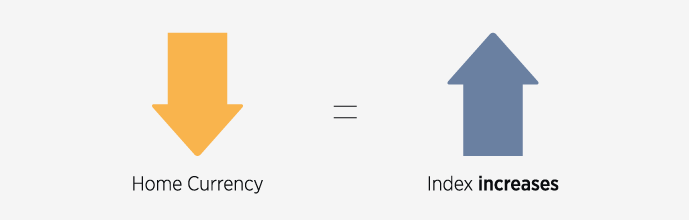

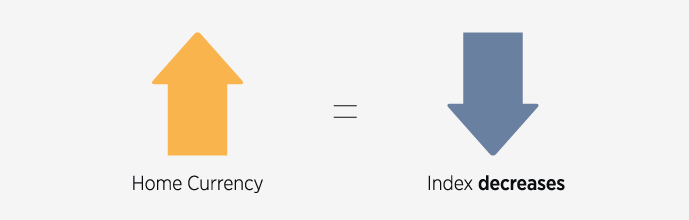

If we aim for a true comparison of prices in the home and host locations, knowing relative currency values is of paramount importance. Cost of living indices are directly linked to exchange rates, and updating an index for a new exchange rate at review time might cause the index to increase or decrease, as illustrated in the graphs below.

If the home country currency loses value against the host country currency, the index will be impacted in a positive way and pushed upwards: more home country currency is now needed to buy the same amount of host country currency.

On the other hand, if the home country currency has appreciated against the host country currency, the index will decrease: less home country currency is now needed to buy the same amount of host country currency.

The fluctuations of exchange rates represent a significant challenge for global mobility professionals, particularly when it comes to the actual delivery of the assignee’s package. We delve deeper into this topic in this blog.

Price changes

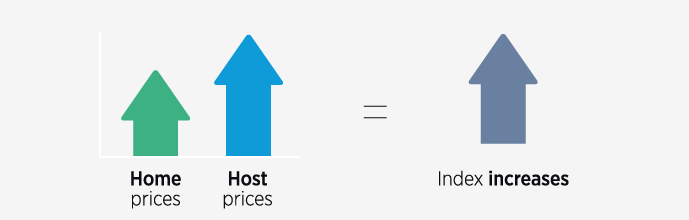

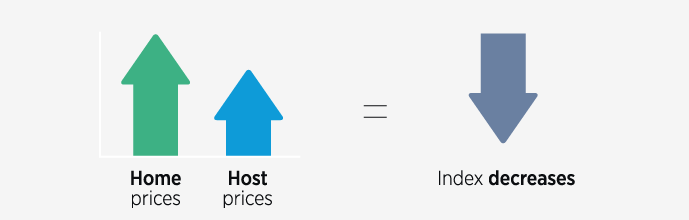

The ECA shopping basket is uniquely designed to measure expatriate expenditure while on assignment and contains over 170 key items. These items represent the goods and services assignees purchase on a daily basis. For this reason, the index is bound to be affected by the relative changes in home and host prices, as illustrated below.

If the prices in the host location increase more than in the home location, the index will increase.

And if prices in the home location increase more than in the host location, the index will decrease.

Quite often, assignees will be unaware of how prices are increasing in their home country. This means they would likely be surprised to see a decreased index when they have seen prices rise in their daily life while purchasing goods and services in host location shops. This is particularly relevant in the current economic climate, where cost of living increases are a reality for most of us all over the world.

It is therefore good practice to remind assignees that costs are also increasing for their peers back home, and that the index is designed to sustain the same standard of living that they would be experiencing if they had not gone on assignment abroad.

If a company wishes to take into account the effect of home price changes, this would need to be done by reviewing the notional home salary of the assignee – in the same way as this would be done for the assignee’s home country peers. Options for how to review expatriate salaries are discussed in this blog post.

Example

Now that we have discussed the theory of index movements, let’s put it into practice and look at the following example focusing on an assignment from Paris, France to Tokyo, Japan.

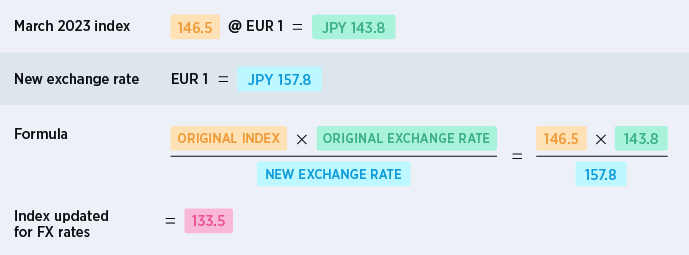

In March 2023 ECA measured a Standard index of 146.5 at an exchange rate of EUR 1 = JPY 143.8.

Six months later, in September 2023, ECA measured a Standard index of 134.4 at an exchange rate of EUR 1 = JPY 157.8.

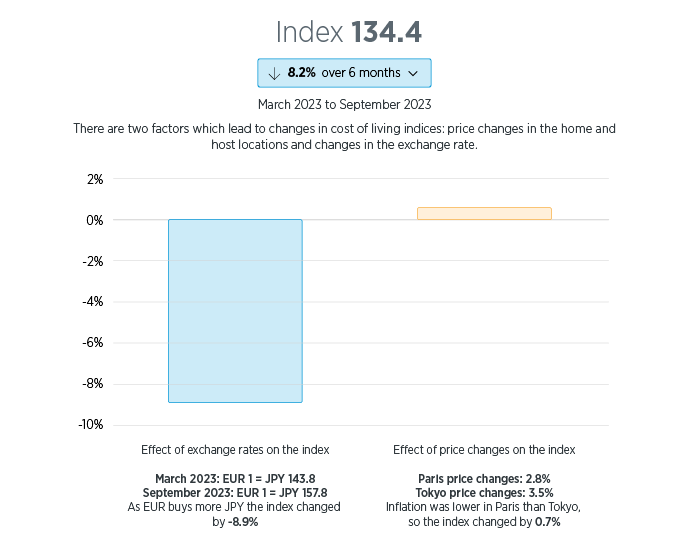

The Index Changes feature in our Cost of Living Calculator shows the relative impact of inflation and exchange rates on specific cost of living indices over six or 12 months in an easily shareable format. The example below shows the cost of living changes between Paris and Tokyo:

Let’s look at this in more detail.

Exchange rates: in March 2023 the EUR was buying JPY 143.8, but by September 2023 the EUR had strengthened against the JPY and was buying JPY 157.8. Consequently, assignees needed less home currency to buy the same amount of JPY, which had a negative impact on the index (i.e. -8.9%).

If we update the March 2023 index to account only for the effects of the exchange rate movements, we obtain the following:

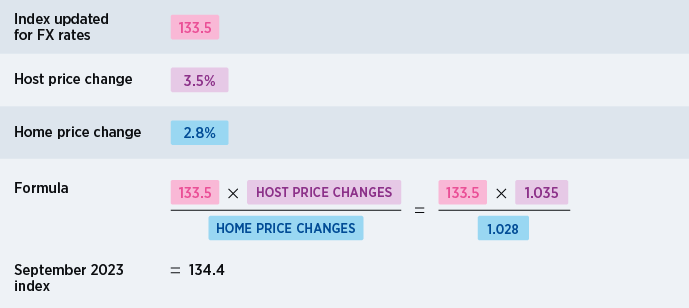

Price changes: we now need to look at the effects of price changes in the home and host countries for the same six-month period. ECA measured that the prices of items in the shopping basket had increased by 2.8% in Paris, whereas prices in Tokyo had increased by 3.5%. Remember, ECA’s measure of price changes will differ from government sources (e.g. official inflation) as they are measuring slightly different things. As prices increased more in Tokyo than in Paris, this had a positive impact on the index. The index is then updated once again to take into account these price changes as follows:

To summarise: between March and September 2023 the overall change was a decrease of 8.2%. The index was negatively impacted by the strengthening of the EUR against the JPY and this outweighed the small effect of the higher increase in prices in Tokyo than in Paris.

Applying the new index to the assignee’s pay ensures that their home purchasing power is maintained. In the example below (where the family size is married with two children, gross income is EUR 100 000 and net income is EUR 73 972) the host spendable is lower in EUR terms – but it’s crucial to look at the host spendable in host currency terms, which has increased. Regardless of which currency it is delivered in, the host spendable (i.e. home spendable plus COLA) is the portion of the assignee’s package spent on living expenses during the assignment in the host location and in host currency. In our example, when the host spendable is converted from EUR into JPY, the lower EUR figure counteracts the more favourable exchange rate, so that the exchange rate movement has no overall impact on the host spendable in JPY. Meanwhile, the assignee’s buying power needs to be protected from the higher rate of price rises in Tokyo than at home, and there has been a slight increase in home spendable – and it’s these two factors that cause the host spendable in JPY terms to rise.

The higher home spendable in September 2023 reflects the figures from new government expenditure tables for France. Due to the current cost of living crisis, people are not able to save as much money, needing to spend more on goods and services. More information on spendables can be found in this blog post.

| |

Home Spendable (EUR)

|

COLA (EUR)

|

Host Spendable (EUR)

|

Exchange Rate

|

Host Spendable (JPY)

|

|

March 2023

Index: 146.5

|

50 861

|

23 650

|

74 511

|

EUR 1 = JPY 143.8

|

10 714 734

|

|

September 2023

Index: 134.4

|

51 514

|

17 721

|

69 235

|

EUR 1 = JPY 157.8

|

10 925 254 |

Summary

There are two factors that impact the index: exchange rates and price changes of the ECA shopping basket in both home and host locations. A change in index will impact the COLA but it’s crucial to remember that any changes will maintain the assignee’s purchasing power so that they are no better or worse off than they would be in their home location.

FIND OUT MORE

To help our clients, ECA publishes articles after each COL survey summarising the major trends and changes around the world. See our latest highlights map published in December here. You can also view the impact of the relative impact of inflation and exchange rates on your specific cost of living indices in a clear and easy graph format using the Index Changes feature in the Cost of Living Calculator.

ECA can support you and your team with advice on cost of living, price changes and exchange rate management. Your account manager will be more than happy to help you with explaining any index movements, so do get in touch.

Please contact us to speak to a member of our team directly.