Exchange rate fluctuations are undoubtedly out of the control of employers. However, this doesn’t absolve them of the responsibility to implement processes to shield assignees from adverse effects.

Getting exchange rate protection right involves aligning multiple processes correctly. Depending on how the company delivers pay to its assignees, different strategies can be adopted to optimally manage exchange rate fluctuations.

Monitoring exchange rates is essential when managing international assignee salary packages because currency movements can have a big impact on their value, or perceived value. For example, a cost of living allowance calculated six months ago may no longer be enough to protect an assignee’s purchasing power if the currency they are paid in has weakened during that period. Conversely, companies may be overpaying if that same currency has strengthened.

With recent variances in exchange rates hitting the headlines, assignees are becoming more aware of adverse impacts on their pay packages. The result? Global mobility teams are only an email away from having the company policy or approach scrutinised!

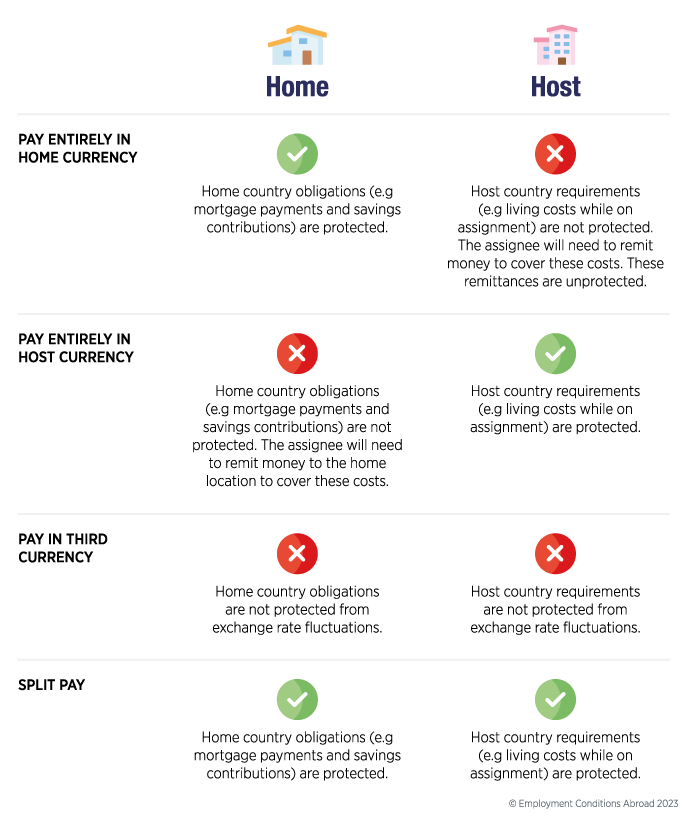

The first step in preparing for such challenges is to determine which element of the salary package you need to protect. This comes down to how you deliver pay:

Split Pay – A potential solution?

In theory, split pay means that both the home and host-related elements of the salary are protected. At ECA, we use spendable data to determine an accurate split of the net salary, taking into consideration that the portion needed in each location will vary according to nationality, family size and salary level. The split must accurately reflect the assignee’s consumption pattern in each location so that there is no need to transfer money across, effectively taking exchange rates out of the equation.

One drawback – split pay is a more complex method to administer as it depends on a dual payroll capability. Legislation in certain countries means that split pay is not always a viable solution. In Russia, for example, 100% of the salary must be delivered in roubles.

Something to be aware of – split pay is not designed to be an opportunity for the expat to play the “exchange rate game” whereby they might choose to have, for example, 90% of their pay delivered in the currency expected to appreciate, so that they receive a windfall when transferring money over at an increasingly favourable exchange rate. In this scenario, should the rate then become less favourable, or indeed become unfavourable, would you feel obliged as a company to protect further? If you allow the expat to decide the split, the onus should be on them to make sure it is appropriate. We advise you to establish a limit on the number of times the split can be reviewed. Our suggestion would be to let them review three months into the assignment, then on an annual basis.

So what other options are there when not operating split pay?

Guaranteed exchange rate

Guaranteed exchange rates are used by a third of companies applying the build-up approach. In this scenario we assume that the employee’s salary is delivered 100% in one currency, either the home or host, and that the company uses a fixed exchange rate when the employee makes a currency swap.

The guaranteed exchange rate used can be determined in various ways. It could be a company accounting rate, the rate given with the latest cost of living index, a spot rate, or an average rate over a specified time period.

The pros: the employee remains protected against fluctuations without requiring the company to have a dual payroll capability. The assignee doesn’t have to worry about whether the exchange rate will move against them and affect them unfavourably over the time period, as the company will pay whatever is necessary to ensure the guaranteed exchange amount is met.

The cons: this option is administratively burdensome since it potentially needs updating on a monthly basis, depending on how you fix the rate. There are companies that offer assistance with this though, and it may be possible to get banks to offer a fixed rate for a fixed amount of time.

Overall, this is a better option for those with smaller assignee populations (with fewer home and host locations) as there will be fewer currency combinations to manage.

Interim Reviews

The majority of companies undertake scheduled reviews of expatriate salaries once a year. The interim review approach involves establishing a trigger point to determine when a currency movement is significant enough to warrant an out-of-cycle review, to ensure that the value of the salary package isn’t eroded. The most commonly cited trigger percentage, according to our survey data, is 10%.

Once a company’s chosen trigger has been surpassed, a ‘wait and see’ time frame is usually established to check that the movement is not a temporary anomaly and to avoid the company intervening prematurely. If the change is sustained for the chosen period (periods of three and six months are most commonly quoted) the company will conduct an interim review and backdate the calculation to when the trigger was originally breached.

The pros: there is a clear message that the company is proactively looking to protect the assignee because, in extreme cases, the individual will not have to wait for an annual review to take place to realign their exchange rates to the market.

The cons: significant additional administrative work is needed to monitor fluctuations regularly. It is also important to note that the employee isn’t protected for all fluctuations. If, for example, the trigger is 10% but the movement falls just short of this at 9%, the employee will likely be unhappy that they will not be compensated for this still sizeable difference.

Reconciliation

With this approach, the employee’s salary is delivered 100% in one currency, but the amount received on transfer in the other currency is compared to the expected amount periodically. If the received amount is less than the promised amount, the employee is out of pocket until they are reimbursed, which could be problematic depending on how adverse the rate is and how frequently you reconcile. Typically, this is done every six months or annually.

The pros: there is no need for dual payroll.

The cons: this is the most laborious of the four methods and it is perhaps unsurprising that only 14% of companies adopt this approach. If you are under pressure to save costs this probably isn’t the best option for you, as it’s unlikely that a company will reclaim money when the employee has benefitted from currency movements. Indeed, 71% of organisations that use the reconciliation approach allow the assignee to keep the gains. An alternative would be to apply a threshold so that reimbursements are made only if the loss exceeds a certain percentage.

Summary

Unfortunately, predicting currency movements is beyond global mobility teams’ powers. What you can do, however, is be proactive and keep an eye on currency volatility so that you are ready to intervene when appropriate.

As exchange rates can have a big impact on the value - or perceived value - of the package on offer, a clear protection approach and good documentation are both key.

Our advice is to have an exchange rate protection policy in place, rather than responding on an ad-hoc basis to expat kickback. This will not only promote assignee equity but also ensure that the application of your chosen protection method is consistent and avoid setting a precedent for exceptions. The best approach for your organisation will depend on your payroll capabilities, the countries you operate in and your company culture.

FIND OUT MORE

ECA’s Consultancy & Advisory service can assist you with the design of an exchange rate protection policy, or the review of a current one. They can also ensure your assignment letters communicate your organisation’s pay approach: in which currency, through which payroll, and how exchange rates will be managed.

ECA’s Cost of Living Summary Calculator allows you to track volatile currencies and high inflation countries by downloading indices and index changes with a single click, highlighting the locations beyond your specified thresholds. Additionally, our monthly currency review blog posts will keep you updated.

Please contact us to speak to a member of our team directly.