In practice assignment letters, or assignment agreements, often consist of little more than confirmation of the assignment location and job title, without giving details of assignment duration, compensation, tax, benefits and other important issues. The lack of such information leaves much to interpretation and may cause considerable disruption at a later stage if assignees have a different understanding of how a particular issue, for example tax on personal income, will be treated while on assignment.

By setting up a comprehensive assignment letter which is discussed in detail with and then signed by the assignee prior to the assignment, such conflicts can be avoided. Expectations are managed at the outset and assignment terms and conditions are clear to all involved, particularly the assignee, but also home and host HR and line managers. Furthermore, the document will serve as clarification for other departments such as Payroll or Finance as well as for external parties, in particular, of course, the company’s tax service providers. In the event of an audit by the tax authorities, it is very common for auditors to request copies of relevant assignment letters; it is therefore crucial that the assignment agreement correctly reflects the assignment terms and is in line with how the assignment is actually managed in practice, in particular with regard to assignment compensation and the corresponding treatment of tax and social security.

So, how detailed should an assignment agreement be? The answer is as detailed as possible. The assignment letter should be a legally binding document, confirming the agreement between the company and the assignee with respect to the terms and conditions of the assignment. In reality, the most common approach is that the assignee remains employed with the home company and the home employment contract remains in place. However, the assignment letter serves as an addendum to the employment contract and confirms the terms and conditions which vary from the normal contract while on assignment. Any terms and conditions not specifically varied therefore remain as per the home employment contract.

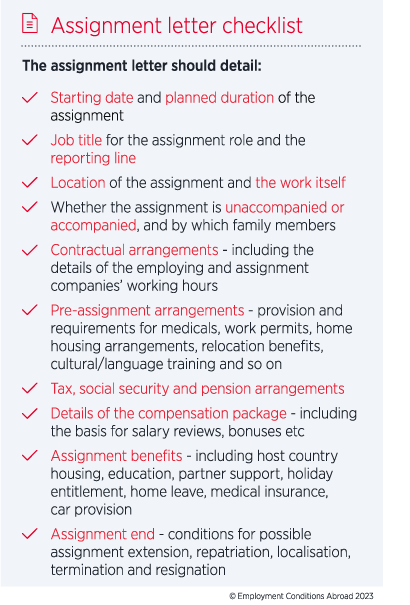

Most of the checklist items opposite will require considerable scoping – particularly if no assignment policy exists, but making well outlined provisions will prove worthwhile. The extent to which each item should be explained is illustrated below for three key areas.

Compensation, tax and pension arrangements

This is possibly the most complex and important part of the assignment letter and must clearly explain how the assignee will be compensated while on assignment. If the company uses a build-up or balance sheet approach, this section of the agreement will confirm details such as the home notional salary, cost of living adjustments, assignment and location allowances and, of course, the assignment salary.

It should be confirmed whether the assignment salary is guaranteed net or gross, as well as where and how it will be delivered, i.e. through which payroll, in which currency, details of split pay arrangements, exchange rates, etc. If the company has a variable pay structure details of how bonus and incentive payments will be calculated and delivered while on assignment must also be included.

The process for salary reviews must also be explained, as well as the treatment of assignment compensation for tax and social security. Assignees will normally remain in home country social security plans while on assignment, subject to the relevant regulations, and this should also be confirmed in the assignment letter. This section of the agreement will also give details of the tax services provided to the assignee, e.g. departure and arrival meetings, tax return preparation, etc. And finally, the pension arrangements should be confirmed.

Of course, if the assignee is to be compensated according to a different approach, e.g. the assignment salary is based on the local compensation levels of the host location as opposed to the build-up method, similar details to the ones described above should be given, which confirm the assignment compensation and tax treatment

Assignment benefits

The most significant benefits, both in terms of cost to the company as well as value to the assignee, are education allowances for the assignee’s children and host country accommodation. The assignment letter should clearly explain the level of benefits provided and how they are delivered, i.e. in-kind or in cash, bearing in mind the most tax effective form of delivery for the company depending on host country tax legislation. Tax charged on assignment benefits can be considerable, sometimes up to 50% of total assignment costs.

With education benefits it is important to state the type of schooling for which the company will provide assistance. If there are limits on the amount up to which the company will pay for education, or limitations on the choice of schools, this should be confirmed.

Similarly, the limits up to which the company will pay for host country accommodation must be set out clearly. The letter should also clarify what happens if the assignee chooses accommodation below or above the set rental limits.

End of assignment

If there is the possibility of an assignment extension beyond the initially-agreed term, the applicable policy should be detailed here. Most importantly, a maximum duration beyond which the assignment will not be extended should be indicated. This avoids situations where employees become “permanent” assignees, remaining on assignment terms and conditions well beyond five years, which is generally the most common maximum assignment duration.

It is also good practice to give details of the company’s localisation policy in this section. It may well suffice to confirm that a localisation policy may be applied once the maximum assignment duration has been reached, without having to give too many details on the actual process. But by mentioning the possibility of localisation in the letter, assignees’ expectations are managed and they are aware that assignment terms will not continue indefinitely.

In the repatriation section the agreement should confirm the relocation assistance provided; e.g. shipping, temporary accommodation, relocation lump-sums, etc. Furthermore, this section should confirm the process and time scales for finding a suitable position for the assignee upon returning home.

Finally, assignment letters rarely differentiate between terminating or resigning from the assignment, as opposed to terminating or resigning from the actual employment with the company. It is good practice to include the relevant terms and notice periods for each of these scenarios here and to differentiate accordingly. Terminating the employment of an assignee can be complicated and this section of the agreement should be very well thought through. Unfortunately, the governing labour law is often unclear or not straightforward to determine. A company should always seek legal advice should a labour dispute arise.

FIND OUT MORE

Need help with assignment letters? ECA's Consultancy & Advisory team are on hand to critique your company's assignment letters or create assignment letter templates in line with your policy, as well as offer expert advice and guidance on content so that your assignment letters accurately manage the expectations of the employee and the company. If you'd like to speak with one of our Consultants, you can request a callback here.

Please contact us to speak to a member of our team directly.