In our previous blog posts on international remote working we introduced the concepts involved, and discussed the compliance challenges associated with them. In this post we look at the salary and benefits considerations of international remote working. As with the previous posts we will cover both virtual assignments and international flexible working and we will aim to look at the different considerations companies need to make when setting their policy.

Starting with salary, it may initially appear simple with the option to just continue providing the current ‘home’ salary seeming the obvious choice; but taking a closer look reveals the situation is far from simple and this might not always be the correct decision.

Primarily, we need to consider things from a legal perspective and as the employee is effectively working in’ a different location to the one they live in, companies may need to be compliant with laws in both locations. The first step is to ensure the salary is sufficient to meet minimum wage requirements (for the specific visa type the employee is working on) in the location where the work is being carried out. There may then be other legal requirements such as how the salary fits relative to other positions in the organisation, mandatory bonuses, overtime pay, and other specific mandatory allowances. Once legal minimums have been considered the company then needs to decide what its philosophy is going to be regarding the salary of employees who are on virtual assignments and those under international flexible working arrangements.

Salaries for virtual assignees

For virtual assignments, as the company is asking an employee to perform a role remotely one aim is to at least make sure the employee is no worse off than if they were simply performing the role (which may be a different role to the one they are currently performing) in their home location (a similar principle to the home-based approach for long-term assignments).

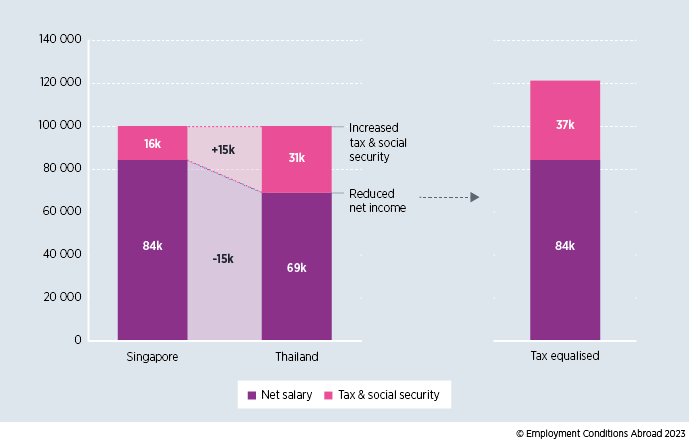

Based on this, the company needs to consider if continuing to provide the same gross salary that the employee earned prior to commencing the virtual assignment means the employee will receive the same net income as if they were working at home. Our previous post, which covered tax and social security compliance, shows that this may not be the case. The employee themselves may be liable to pay tax and/or social security contributions on their income in multiple locations, or the tax rate might simply be higher in the country which is the source of their income. Therefore, in order to deliver the same net salary the employee received before the virtual assignment commenced the company will need to tax equalise the employee and meet any additional tax liabilities.

A relatively simple example would be an employee working in Singapore who currently earns USD 100 000. While working in Singapore they would pay tax and social security there and receive a net income of around USD 84 000. But if they remained physically in Singapore but were now asked to remotely perform a role in Thailand, they would be required to pay tax and social security in Thailand, as well as social security in Singapore (in this case they would not be taxable in Singapore). The same gross income of USD 100 000 would now see them only receive a net income of around USD 69 000. So, to ensure the employee would continue to receive the same net as before the virtual assignment of USD 84 000, the cost of tax equalisation would be USD 37 000. The company would therefore need to pay the employee a gross salary of over USD 120 000.

There is also the possibility that the employee could gain if they are only taxable in the location where they are working and the tax rate is lower than that where they live (such as the reverse of the situation above), so a decision about whether to truly tax equalise or just tax protect, i.e. let the employee keep any gains, needs to be made. As discussed in the compliance post, consideration of what happens in cases where the employee is unable to contribute to social security in their home location and if the company will compensate for any loss of retirement income or other benefits should be made.

Already we can see that virtual assignments may not be cost neutral to the organisation, but in addition the cost to the company of employing someone is not limited to the employee’s gross salary – there are employer social security and other insurances and costs to consider.

So, while the intention may be to continue to provide the employee a net salary consistent with the location they are living in, the gross salary required and costs to the company are potentially higher than prior to the assignment. Although this additional cost will usually be less than sending someone on a long-term assignment, since there are no relocation costs incurred by the company and no typical assignment-related allowances or benefits paid, it still needs to be considered.

Salaries for international flexible workers

For international flexible working the situation may be simpler in cases where an employee requests to leave the country where they were hired and work remotely from overseas. Once the legal considerations discussed above have been made, companies may be happy to take a hands-off approach and simply maintain the current salary, letting employees manage the tax and cost consequences of living overseas. However, if companies do want to take a more active approach they need to not only consider if they are prepared to meet any costs in addition to the current salary but also what the fundamental amount they are prepared to pay for the role is, and how that is determined.

These considerations are also necessary for cases where companies may be directly hiring employees from overseas but with no expectation of them relocating to the location where the role is to be performed, a kind of ‘international remote hiring’. If a company finds that the skills and expertise they need are not available in the country they need them, nor within the organisation they may elect to recruit external talent from any part of the globe and, if the job can be done remotely, have no need to relocate those employees away from their current location.

For these more complex cases, companies may firstly want to make an assessment, similar to that for virtual assignments, of the tax and social security situation and, as employees are unlikely to be able to make an accurate assessment themselves, provide the employee with some guidance. While some employees may be willing to take a reduction in net income in order to live overseas in a favoured location, the question of whether the company is willing to pay for any additional employer costs, such as payroll taxes or social security contributions, remains. As mentioned in the second blog post in this series, companies will most commonly restrict international remote working to locations where the company has a presence in order to maintain a continued employment relationship with the employee, and this is likely to incur employer social security costs in the location. For example, employing someone in France, where employer social security contributions can be around 50% of the gross salary, is likely to result in a much higher cost to the company compared to employing someone on the same salary in neighbouring Germany. So, if the company has determined it will not meet any additional costs, they will need to calculate a new salary for the employee factoring in the employer costs.

Another consequence of employees choosing to work overseas is that their salary is likely to be paid in a different currency to the one they need for day-to-day living. In addition to the administrative issues associated with this, companies need to decide if they will make any considerations for exchange rate fluctuations.

Ultimately, companies may be forced to consider how they determine the market rate salary for a job that can be done from anywhere. And if employees are free to work from anywhere, and they can work from multiple countries, this becomes an almost impossible task to determine the market rate salary.

Finally, when considering salaries for international flexible workers we can imagine a couple of scenarios:

- Two employees at the same company and same job level live and work in a high cost, high salary location and they both receive the same salary. One is able to work remotely from a low cost, low tax country and the other is not because the particular role they perform requires them to be in country. As such the employee who is able to live overseas is materially better-off. Is this fair? If the salary for the employee living in the low-cost location is not reduced do roles which can’t be done overseas or remotely now need to attract a premium? Indeed, there have been various news stories about tech companies in the USA reducing salaries for employees who choose to leave Silicon Valley and work from cheaper locations within the USA.

- Two employees at the same company work at the same job level. One works in Germany and gets paid a commensurate German salary; another works in Bulgaria and gets paid a considerably lower salary in line with the market rate in Bulgaria. If the German employee decides they wish to work from Bulgaria, and the company makes no adjustment to their salary, they will now be earning considerably more than all of their colleagues in Bulgaria for doing the same job and living in the same location. We can see the differences in the extract below from our National Salary Comparison tool. Again, issues of fairness arise.

So, although international remote working is mostly driven by employee choice, and companies are unlikely to provide much assistance in the vast majority of cases, a fully hands-off approach might not be suitable. Some may at least consider it part of their duty of care, or part of internal approval processes, to provide an assessment of the impact to the employee so they are fully informed about their decision. As part of this, a net-to-net comparison can be run to provide an assessment of how much better or worse off an employee is likely to be. This kind of calculation enables companies to assess either on a net level only, or by factoring in relative buying power and housing costs to find the salary they would need to provide to protect their employee’s net salary when they are working overseas. This kind of calculation can therefore demonstrate the value of the salary to the employee and make sure that there are no surprises in store.

Benefits

Moving on to benefits, and once again the primary consideration should be what is legally required. This may be governed by the country where the employee is employed and/or the one in which they are living and is likely to include things such as annual leave, sick leave, public holidays, maternity and paternity leave. Legislation around other benefits is quite rare but should still be checked.

As part of our Managing Mobility 2021 survey, we asked about the support that companies are typically providing to employees who are on virtual assignments, and this is shown in the chart below.

Support was quite limited, with over 20% of companies providing nothing. Of those that do provide additional support the most common item provided was technology to facilitate remote working with around 45% providing additional technology on top of what they provide to the rest of their workforce.

Otherwise, the main things provided were tax and immigration advice and tax equalisation; i.e. meeting any additional tax burden the employee may face while on assignment, which we discussed above.

Although virtual assignments have been around for a long time, they grew in prominence during the Covid-19 pandemic as companies often needed emergency and short-term options at the beginning or end of actual assignments. This meant few companies put together formal policies on the benefits to be included. Although around 80% of companies in 2022 said they expected to see an increase in virtual assignments, this was from a very low base level, with less than 50% of companies having used this type of assignment previously – and those that had typically had very few virtual assignees. As such, having a policy on additional provisions for virtual assignments remains relatively rare.

FIND OUT MORE

Have a look at the other blog posts of the series to refresh your knowledge on international remote working:

Our new International Remote Work Report is now available to purchase, or free to those who participated in the survey! (Updated January 2024)

Please contact us to speak to a member of our team directly.