With the inescapable headlines highlighting rising costs of utilities across the world, ECA’s clients are more frequently raising questions such as:

- “What are other organisations doing to deal with rising utility costs?”

- “My assignees have asked for additional compensation to cover increased utility costs in their host location, how should this be dealt with?”

- “In the market, are companies reviewing their utility cost payments more regularly?”

- “What is the best market practice for managing utility reviews?”

Providing assistance with the cost of household utility bills on assignment is commonplace, with 32% of respondents in ECA’s Benefits for International Assignments Survey always providing assistance and 8% providing assistance in certain circumstances. A further 27% assist by providing a cost of living adjustment (COLA) which includes differences in utilities costs. Only a third of companies do not provide any assistance.

The following chart shows the most common category of costs covered by employers who provide this assistance:

The most frequent methods of delivering utilities are as a benefit-in-kind (39%), where the employer pays directly, and having assignees pay their own bills before claiming the expense as a reimbursement from the organisation (38%). Providing a cash allowance for this benefit is less popular, with just 17% of respondents using this method. The remaining 6% deliver the benefit in the most tax-efficient way.

With such a range of utilities covered and a variety of approaches available for compensating assignees for this expense, it can be difficult to pin-point the right one for your organisation at the best of times, let alone when assignee pressure comes into play.

Therefore, our clients have unsurprisingly increased their interest in the wider market’s approach to managing the provision of utility assistance, particularly in locations that have had significant hikes in prices.

With each approach come different challenges for our clients, but there are always different ways for employers to strategically manage the costs involved, while also being transparent in communicating their aims and intentions to their globally mobile populations.

Approach & Challenge 1: Providing a cash allowance

Approach & Challenge 1: Providing a cash allowance

In scenarios where an allowance is provided to cover utility costs, an employer may be looking to review it on a more frequent basis in times when costs are fluctuating drastically, to ensure it remains fair and reasonable. Assignees may approach employers about increased costs if they don’t believe allowances provide sufficient coverage.

The employer can counter such claims by agreeing to consider more frequent reviews, while holding onto the advantages the method provide.

Benefits of providing a cash allowance:

- Reduces the administrative burden for the employer having to make reimbursements for actual costs across their globally mobile population

- Changes an unknown, unlimited cost into a known fixed cost

- Environmentally friendly, as an allowance encourages assignees not to be wasteful, since they aren't being reimbursed for unlimited utility use, but must work to a budget

Best practice & Considerations 1

Based on results from ECA’s Benefits for International Assignments Survey, utilities provision is mostly reviewed less often than once per year, with 52% of respondents doing this. 61% apply the reviewed budgets to employees already on assignment, with the remaining 39% fixing the initial utilities budgets for the assignment duration.

Employers may look to increase the number of reviews that take place in light of turbulence in the market. ECA publishes utilities data twice a year, which should be more than sufficient in terms of easing your employees’ concerns, knowing that their allowance is being actively assessed to compensate them at a fair and accurate rate. Establishing a solid process for reviewing costs on an ongoing basis will not only provide reassurance to assignees, but also ensure that the employer is reflecting current data within their budgets. If allowances are only altered at the request of an assignee, the company risks setting a precedent of only seeing increases in their allowance provision.

Approach & Challenge 2: Adding utilities to the cost of living basket

Approach & Challenge 2: Adding utilities to the cost of living basket

Where an employer includes utilities within their cost of living basket for the assignee’s cost of living adjustment (COLA), one question in these unpredictable times is, do the cost increases an individual may be experiencing in their host location, or seeing in local media, actually require the employer to apply additional provisions?

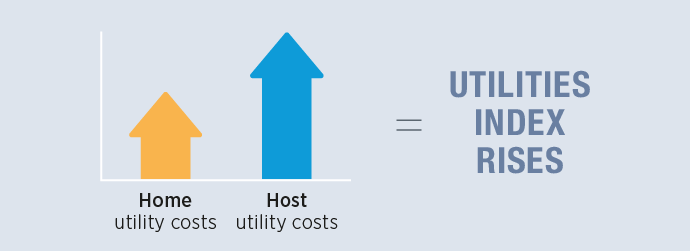

Where utility costs are rising in the host location at a higher rate than in the home one:

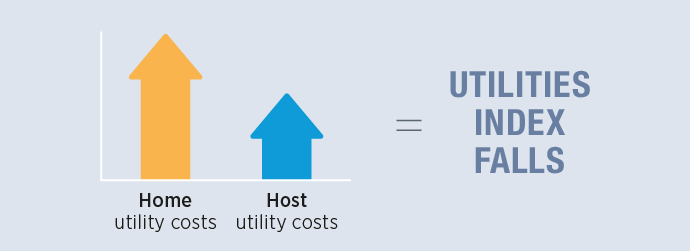

Where utility costs are rising in the host at a lower rate than in the home:

As demonstrated above, in times where the host utility costs are rising, it is important to also be conscious of the utility costs in the home location. The assignee’s first-hand experience may be a rise in utility costs in the host, but this may not reflect the wider picture.

Best practice & Considerations 2

ECA advises companies to ensure they have clear communication with assignees in these unprecedented times, to educate them on the mechanics of a cost of living adjustment.

The addition of utilities to the default cost of living shopping basket could pull up or push down the cost of living index. Firstly, it should be remembered that this approach considers the difference in costs; utility costs might be high and increasing overseas but they may also be high and increasing in the home location as well. The impact of including utilities in the shopping basket depends on how utility costs overseas compare to those in the home location – whether they are more expensive or less. But it also depends on how that utilities index compares to the item indices for all the other items in the shopping basket (i.e relative consumption of utilities versus other items).

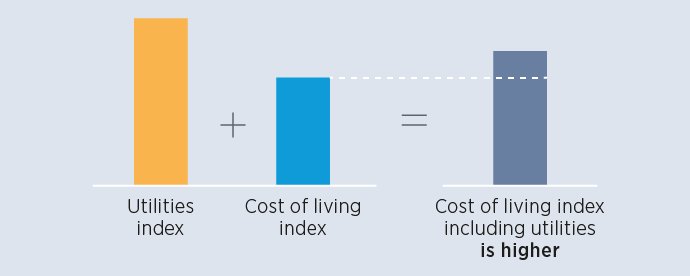

Where utilities are added to the basket and the utilities index is higher than that of the rest of the basket, the result is an increase in the overall cost of living index:

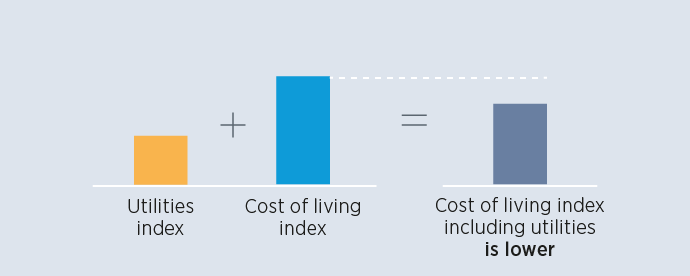

Where utilities is added to the cost-of-living basket and the utilities index is lower than that of the rest of the basket, the result is a decrease in the overall cost-of-living index:

Looking at the maths, if the difference in utilities costs is greater than the difference in the cost of the rest of the shopping basket, an index including utilities will be higher than an index without utilities. Conversely, if the utilities cost differential is not as high as the cost differential of the rest of the shopping basket, then an index with utilities will be lower than an index without them. If adopting this approach, it is good practice to include utilities spendable income in the spendable income that is to be adjusted by a cost of living index including utilities.

When communicating the mechanics of the COLA to your assignees, it is important to ensure that the wording within your mobility policy is reflected in a clear, concise and understandable way.

FIND OUT MORE

If you need any advice on policy review/design around your COLA, or how best to communicate the messaging to your assignees, please do not hesitate to get in touch with our Consultancy team here at ECA who would be more than happy to assist and guide you in this area.

Please contact us to speak to a member of our team directly.