There are always a handful of locations with hot housing rental markets but this year has been hotter than usual with big increases on both sides of the Atlantic. ECA’s March 2022 Accommodation survey focused on North America and Europe with a range of factors pushing up prices in many cities.

The rolling back of pandemic restrictions from late 2021 has led to a surge in international relocation and the return of city-living for many as offices reopened. On the supply side, renters are seeing much lower levels of availability post-pandemic as many landlords exited the market at the height of the pandemic due to a lack of demand. Property construction also slowed due to Covid-19 working restrictions, and high global inflation is slowing the delivery of new properties as the cost of building materials rises.

Demand |

Supply |

| Pandemic restrictions rolled back |

Tourism recovers – many properties moved onto short-term rental market

|

| International relocations resume |

Slowdown in property construction during the pandemic |

| Offices reopened |

High inflation impeding delivery of new properties |

| Appeal of city-living returns |

Many landlords sold their properties during the pandemic |

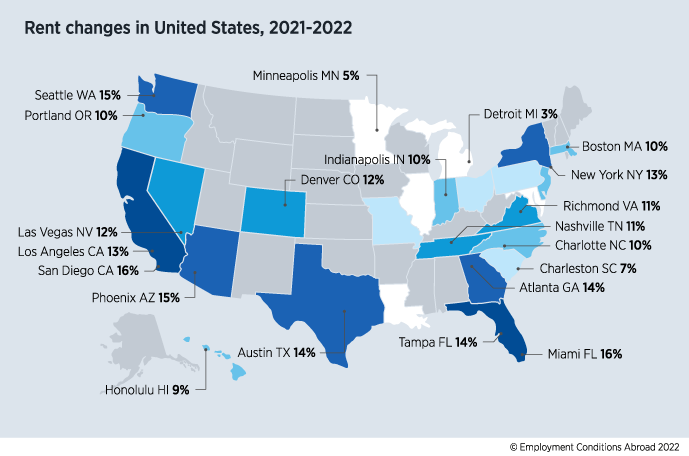

United States

Nowhere has the post-pandemic rebound of rents been more pronounced than in the United States, where almost half of US cities saw rental prices increase by over 10% between 2021 and 2022. Rent growth was not restricted to a cluster of states, with locations on both seaboards and also inland experiencing significant increases in demand for accommodation in popular districts. As companies adjusted to remote and hybrid working patterns, renters found themselves seeking more favourable living environments.

Some of the quickest rental price increases are occurring in the south-east and south-west of the country. Florida became a prime destination for renters during the pandemic, with the state imposing some of the loosest Covid-19 restrictions in the country. With vacancy rates already low before the start of the pandemic, this influx of renters led to record lows in the availability of accommodation and substantial increases in rents in Miami (16%) and Tampa (14%) in our latest survey. Major cities in the south-west have also attracted large numbers of new tenants, drawn to the warmer climate, larger properties and access to nature. The strongest rental growth in the region in our latest survey was seen in San Diego (16%) and Phoenix (15%).

As well as renters seeking improved living environments, increasing numbers of companies have relocated to states with more favourable corporate tax regimes. One of the highest profile moves has been of Tesla, with the firm first establishing a new ‘Gigafactory’ in Austin, later announcing that their headquarters would also move to the city. With a number of tech companies following suit, our survey recorded 14% rent increases between early 2021 and early 2022. Growing technology hubs in Seattle and Atlanta also helped drive rents upwards by 15% and 14% respectively.

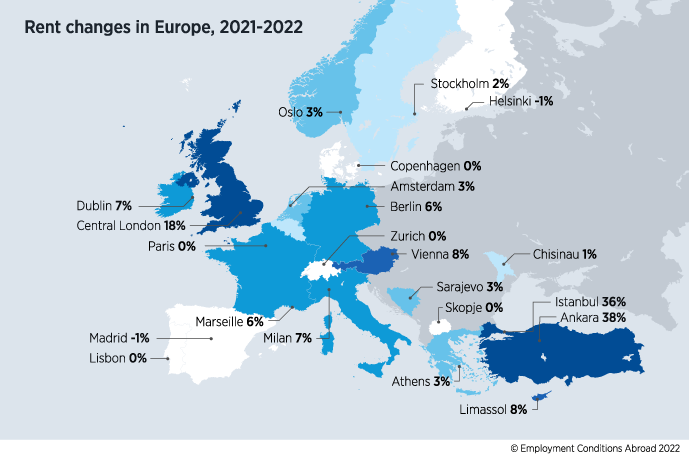

Europe

Rent increases have not been as consistent in Europe, although significant rental growth was seen in many major European cities. Some of the fastest growth was seen in London, where rents in prime central districts increased by a staggering 18% between early 2021 and early 2022. With many companies returning to office working in the autumn of 2021, demand soared in the second half of the year. Renters faced high competition due to a lack of property stock with many landlords selling up during the pandemic. Amid fears of a slump in the housing market at the height of Covid-19, the UK government incentivised the property sales market by temporarily reducing rates of Stamp Duty Land Tax. This led to a sales boom between 2020 and 2021, with many landlords choosing to take advantage of record sales prices by selling.

Higher demand and chronic shortages of housing have affected average rent levels in a number of other European locations including Vienna (8%), Milan (7%) and Dublin (7%). Across western European locations, rental prices increased by an average of 3%, in stark contrast to the static or decreasing markets seen between 2020 and early 2021.

Further east, the highest rent increases in our latest survey were seen in Turkey. Runaway inflation, the heavy depreciation of the Turkish lira and a significant upturn in demand have contributed to average rent increases of 36% in Istanbul and 38% in Ankara between 2021 and 2022. The cost of property construction, heavily reliant on imports of building materials, has spiralled and the market is therefore critically undersupplied.

What will happen to rents in the US and Europe in future?

Rental markets around the world have undergone dramatic changes over the past two years, with a series of shocks on both demand and supply due to the Covid-19 pandemic and high global inflation. Many markets are starting to show signs of cooling as city populations begin to settle, after the initial flood of renters returning to central areas following the reopening of offices and return of mass international travel. The US economy has recently contracted and the UK is set to follow suit, which will act as a brake on rent increases in those countries. While many Eurozone economies are faring better, growth has also slowed which is likely to dampen further rental price rises.

However, a number of factors suggest rents are likely to continue to increase in the second half of 2022. Renters face more limited choice than pre-pandemic due to a downturn in the property construction sector. High global inflation is impacting the cost of building materials and leading to delays in the delivery of new projects. Central banks across the world are turning to interest rate rises to try to curb inflation, which is likely to add to renters’ outgoings in the short term. Landlords will be faced with higher mortgage payments and will raise rents to cover their higher costs. Property developers will have higher borrowing costs acting as a further disincentive to building new accommodation, and many landlords are likely to leave the rental market altogether.

The rapid increase in global economic activity in the months following countries’ routes out of the pandemic led to significant energy demand and higher prices. Russia’s invasion of Ukraine has led to further spikes in energy prices around the world, keenly felt in European countries previously heavily reliant on natural gas piped from Russia. This burgeoning cost of living crisis means that rent increases are likely to moderate longer-term as renters may simply not be able to afford them.

ECA’s September 2022 Accommodation survey will focus on rent changes in Asia, Africa and South America as well as the most volatile markets elsewhere.

FIND OUT MORE

If you need any advice or support regarding accommodation data, trends or your policy, please do get in touch with us.

ECA’s Accommodation Reports give you all the detail necessary to provide the right housing options for your expatriates. They are available to buy on demand or as part of a data subscription for over 420 locations.

ECA's comprehensive accommodation data is also available in our Accommodation Tool. The tool enables you to set and manage a consistent housing policy across all your assignment locations and quickly look up data in tables and maps to respond to challenges and queries.

Our assignment management system,ECAEnterprise, can be used to calculate detailed cost projections that include ECA’s accommodation data. We can also run individual cost projections on your behalf.

Please contact us to speak to a member of our team directly.