We often hear from companies who have moved or are considering moving towards an approach of ‘paying gross’, as opposed to ‘paying net’, for some of their international assignees. However, not all companies mean the same thing by this term which can lead to some debate as to what a company is trying to achieve.

What does it mean to ‘pay gross’?

For some companies, ‘paying gross’ is shorthand for paying an assignee a host country market salary or using a local-plus approach, as opposed to a home country-based approach. Our blog post on the host-based approach explores this pay method.

For other companies, the term ‘paying gross’ is more literal and restricted to how a salary is quoted and processed. It does not necessarily mean that the assignee’s salary references the host country market. They may use the assignee’s home country pay scale to calculate the salary to be paid on assignment, but rather than quoting the salary on a net basis (as is common with the home-based approach), it is grossed up for the employee’s estimated tax liability and social security contributions on assignment. The assignee is then quoted and paid the resulting gross salary, just as a local employee would be quoted and paid a gross salary.

Why use it?

The main reasons we hear for companies choosing to use the home-based approach but pay gross are for simplicity and for cost-savings, as an alternative to tax equalisation.

Tax equalisation, whereby the assignee neither gains nor loses with respect to differences in the levels of taxation between the home country and the host country, is most commonly applied when quoting a net salary using the home-based approach. According to our Expatriate Salary Management Survey, 72% of organisations using the home-based approach apply tax equalisation, the majority of which quote a net salary to their assignees.

However, tax equalisation is generally considered to be both complex and costly. One reason for this is that it requires the payroll to gross up an assignee’s guaranteed net salary every pay cycle in order to withhold the correct tax and social security contributions to be able to deliver the correct salary. If a company’s payroll function does not have this capability, an external payroll or tax provider will likely be required to do this on their behalf, which of course comes at a cost. Likewise, if a company pays a gross salary but reconciles to a guaranteed net salary, either every pay cycle or every year, this may require professional assistance or at least additional administration.

So, if you move to instead guaranteeing the salary on a gross basis only, and not on a net basis, then you no longer have the concern of trying to match a specific net figure, which can be an administrative headache.

Another potentially costly factor in tax equalisation is ‘tax on tax’. In many countries, if the employer bears the employee’s tax liability, the value of the liability itself becomes a taxable benefit, therefore incurring additional tax, which in turn becomes a taxable benefit when paid by the employer, and so on. By quoting a gross salary, which has already considered the tax payable to deliver an estimated net salary, the employer is not paying any tax on the employee’s behalf as such, which eliminates the ‘tax on tax’ risk.

How it works

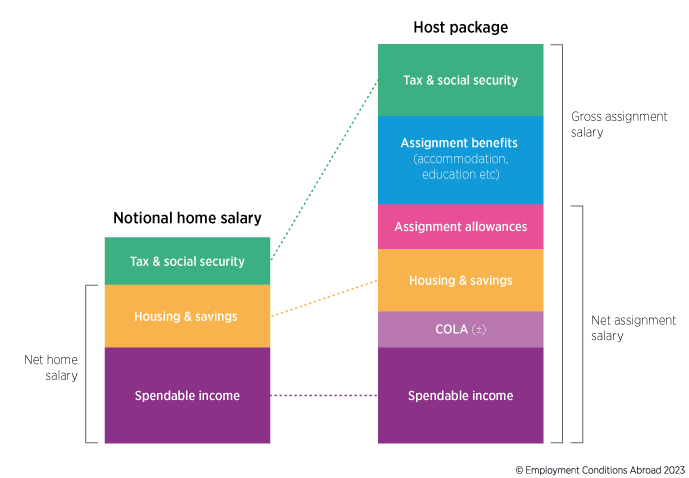

According to our Expatriate Salary Management Survey, 24% of companies who use the home-based approach quote and pay a gross assignment salary with no guarantee of net pay. They run the build-up or balance sheet calculation as normal: start with the notional home country gross salary, deduct hypothetical home country tax and social security contributions, apply a cost of living adjustment and add other allowances to get to a target host country net pay. Where most companies using the home-based approach quote and guarantee this figure to the assignee, those paying gross will gross up this figure for estimated host country tax and social security contributions.

Such companies may therefore be using the concept of tax equalisation to estimate the approximate gross salary an employee would require on assignment that will ensure they are broadly no better or worse off than they would have been in the home country. But by not guaranteeing a specific net salary, they are not truly tax equalising.

The downsides

The main disadvantage is that the assignee will not necessarily receive the intended net salary. There are several reasons why this can happen and the risk can be greater in the first and the last years of the assignment when the assignee’s tax liability is likely to change part way through the host country’s tax year. This can lead to tax credits or deductions being incorrectly apportioned through payroll, meaning the employee has too little or too much tax deducted. There may also be unanticipated additional payments or benefits that impact an assignee’s taxable pay and therefore the net salary they receive.

So, the company has gone to the trouble of calculating a net salary which takes into account home country hypothetical tax and social security, a cost of living adjustment and other allowances, but the actual salary that the employee receives may leave them worse off. The assignee may have been told they are receiving a salary that has neutralised any differences in taxation and cost of living, but what they end up with in their pocket may not reflect this.

What about assignment benefits?

This leads us onto the vital question of how to treat assignment benefits. Most companies, whether they use the home-based or host-based approach, will provide additional benefits to their assignees, such as housing or a company car/transportation allowance.

If a company has used the home-based approach and grossed up the target net salary, any allowances or taxable benefits must be included in the gross-up calculation in order that the assignee does not suffer adversely from the higher taxes caused by receiving these elements. This means that the company must correctly assess and calculate the taxable value of the benefit, which is straightforward if the whole value is subject to tax but not so much if special rules apply to determine the taxable value, as is often the case for housing or for a car. The company also needs the right tax calculation or payroll software to estimate the correct gross salary including the benefits.

What if the company uses the local-plus approach? It may be straightforward enough to establish the assignee’s gross salary by aligning this to the salary scale of the local company. But as soon as the assignee receives any taxable benefits or allowances commonly provided as part of a local-plus approach, such as a contribution towards their housing costs, their net pay will be affected by the higher taxes. If the benefit is being delivered in-kind, the assignee’s net salary will decrease, whereas if it is being delivered as a cash allowance, the net value received by the assignee will be lower than originally intended, eroding the “plus” that is meant to make moving on a local salary more acceptable to the employee.

In order to keep things simple and avoid such problems, companies will often therefore take a generous approach in grossing up the value of benefits and allowances, leading to an overestimation of the tax payable. This is very much to the assignee’s advantage but at a higher cost to the employer.

Other key considerations

There are some other points that should be taken into account when deciding whether paying gross without a guaranteed net salary is a suitable solution.

Which payroll will the assignee be paid through? If the aim of the company in paying gross is to keep things simple, then the logical choice will be the host country payroll. But if there is also an intention to retain the assignee in their home country social security scheme, then a payroll record may still be required in the home country, so there is still complexity inherent with this approach.

Likewise, currency fluctuations can be just as much of a problem when paying gross as when paying net. The assignee may still have ongoing commitments in the home country, such as housing or savings, for which they will need to remit funds to the home country on a regular basis, leaving them exposed to the risk of negative exchange rate movements.

Summary

Paying gross has some notable advantages over paying net, particularly in terms of the potential cost savings and simpler administration of avoiding full tax equalisation where the assignee receives a guaranteed net salary. But it must be applied with careful consideration as to how the salary will be calculated, especially when taking into account the values of allowances and benefits, the impact on payroll and exchange rate issues.

FIND OUT MORE

Clear and comprehensive tax reports are available for more than 100 countries as part of a subscription to ECA data and can also be bought on demand.

Our Tax Calculator enables you to calculate hypotax at the touch of a button, and is used by our Consultancy & Advisory team to run tax calculations on your behalf.

ECA’s hypothetical tax data is also built into our assignment management system, ECAEnterprise, and our Cost Estimate Calculator.If you have any queries about your existing expatriate pay approach, or you are looking to review your policy, ECA's Consultancy team can help.

Please contact us to speak to a member of our team directly.